Table of Contents

Introduction: The Importance of Accurate Business Classification

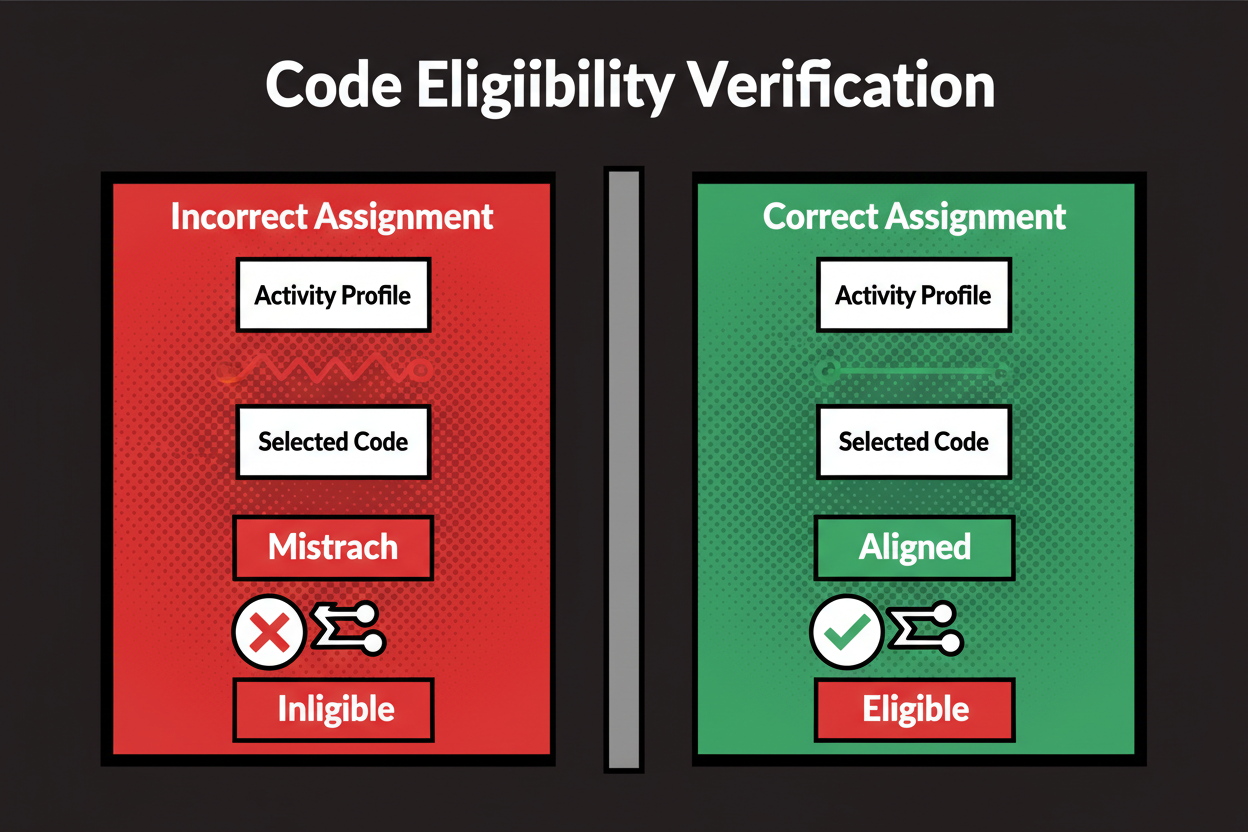

Picture this. You run a growing services firm. You register on SAM.gov, pick a NAICS code that sounds right, and start pursuing federal work. Later, you find out a critical opportunity is off-limits because your code ties to a size standard you can’t meet. You weren’t too big for your industry. You were simply in the wrong industry on paper. The lost time, the rework, the missed bid cycle – it hurts.

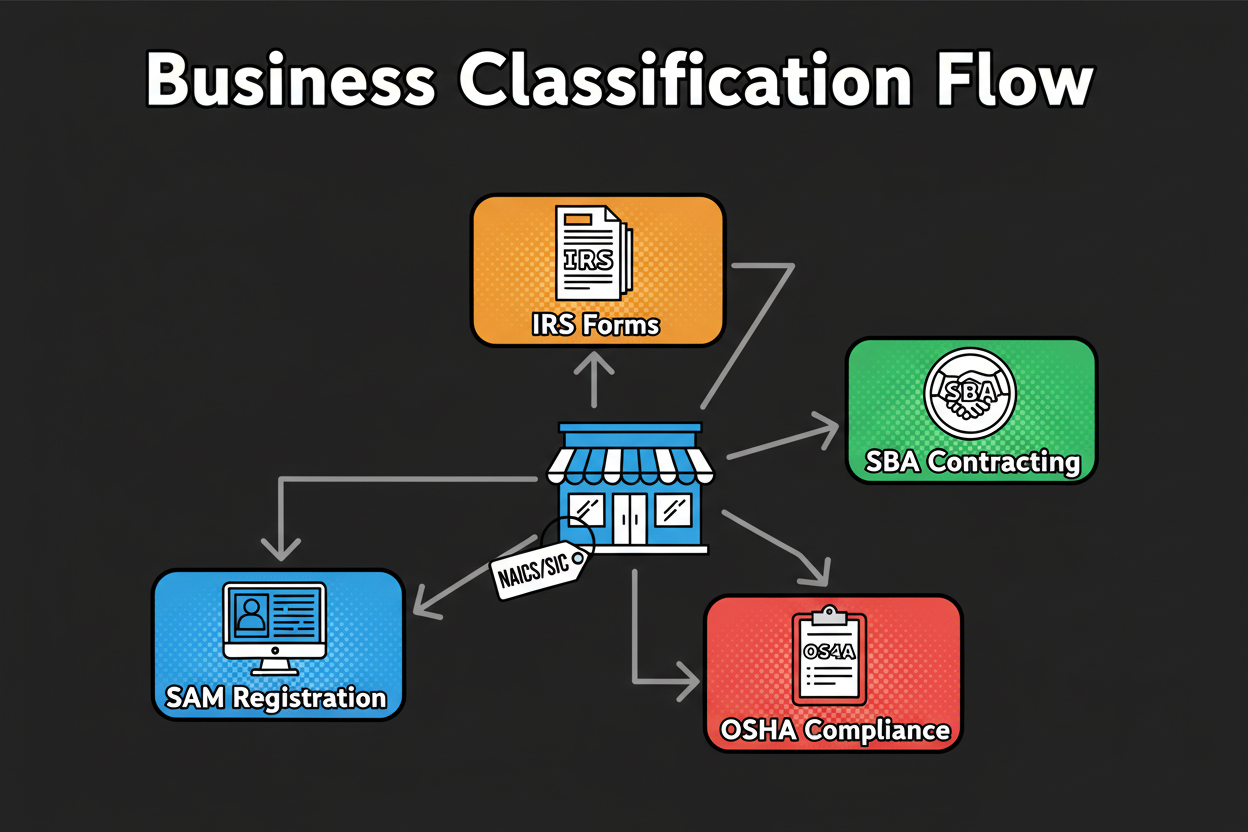

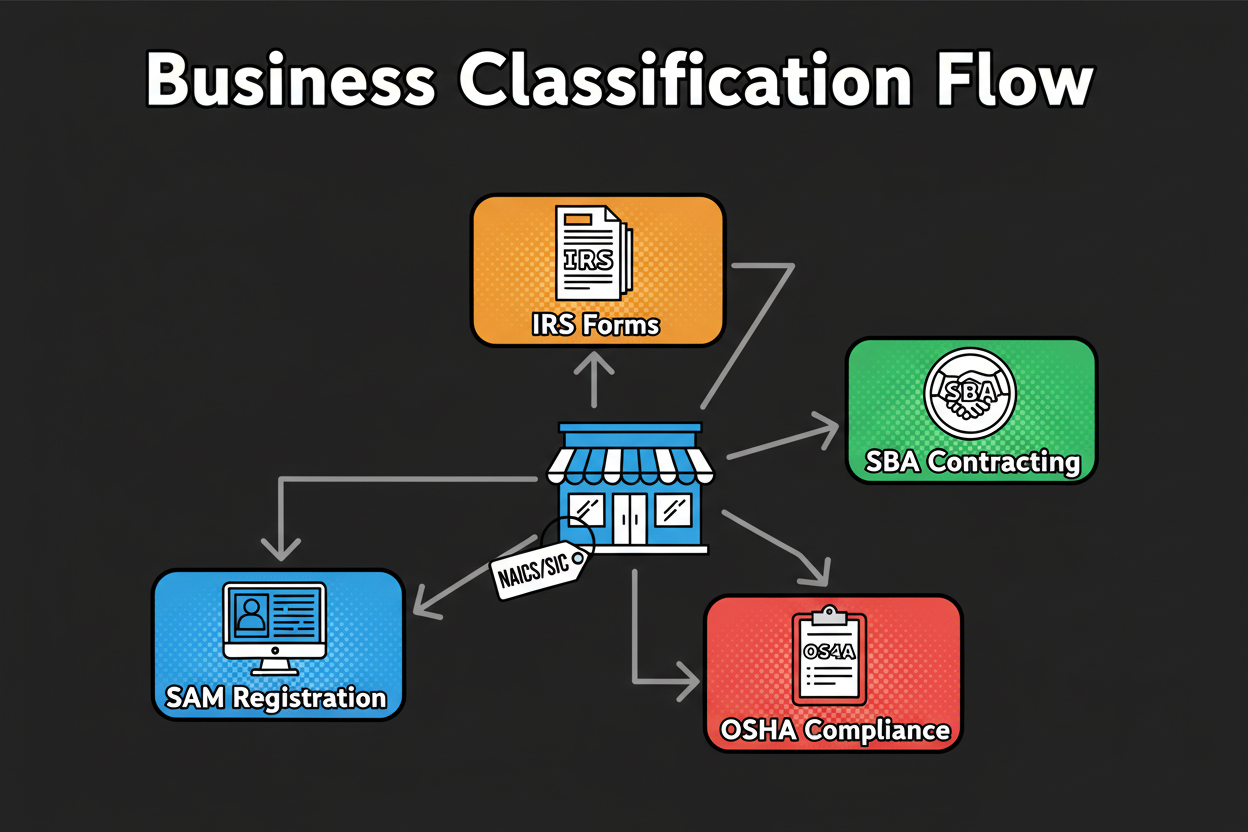

Misclassification rarely causes a fire drill on day one. It shows up at important moments. A banker asks for your industry code during underwriting. A contracting officer assigns a NAICS you don’t expect. An OSHA recordkeeping rule applies (or doesn’t) based on how you’re classified. Or your tax preparer needs your principal business activity code. Each touchpoint depends on accurate NAICS and, in some contexts, SIC. Getting this right ahead of time saves you from delays, ineligibility, and avoidable admin costs [reference:5][reference:6][reference:10][reference:9][reference:12].

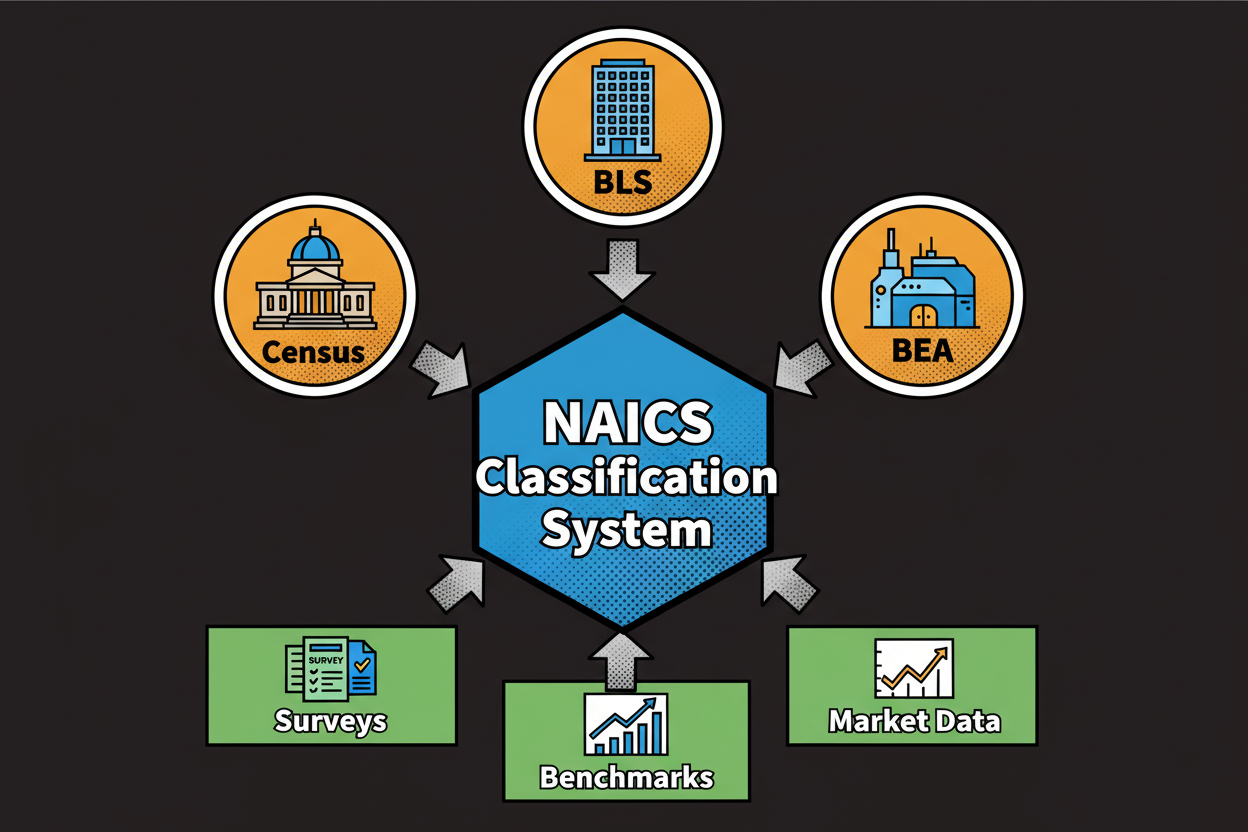

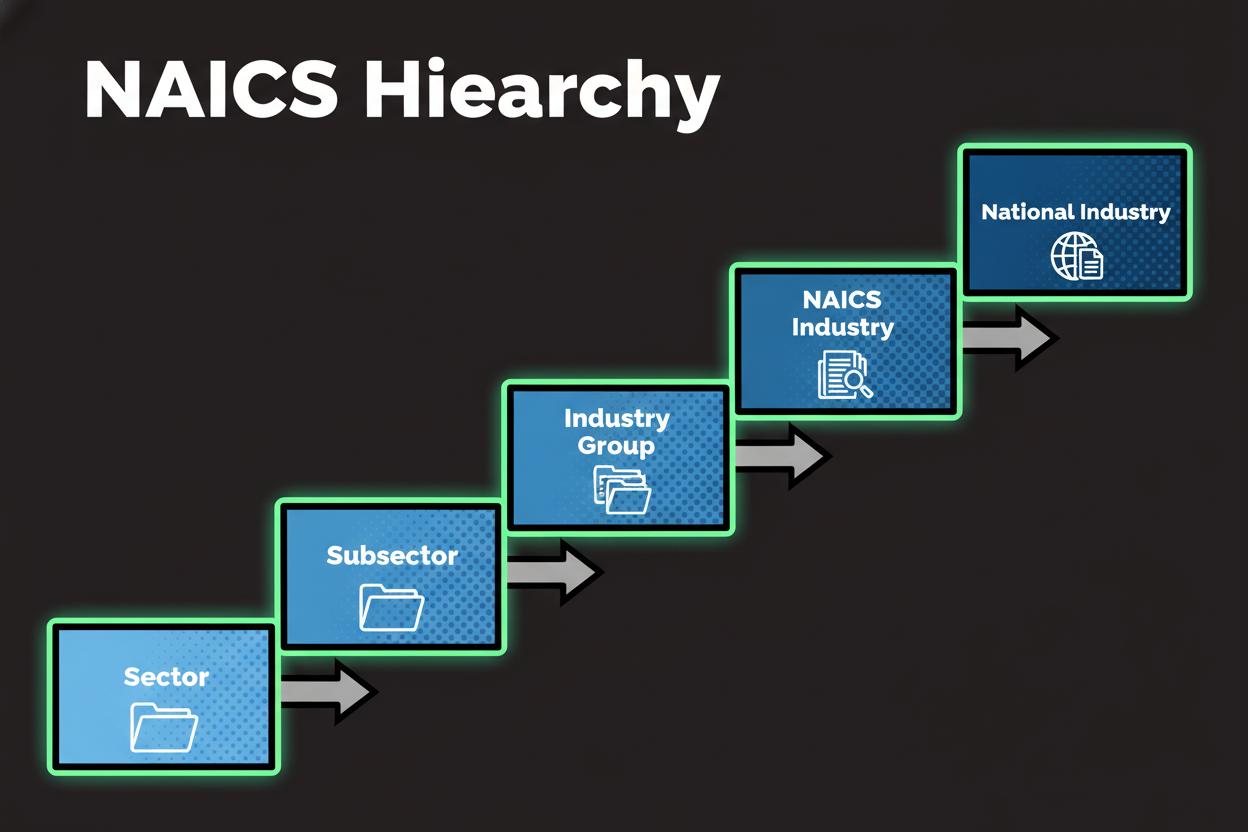

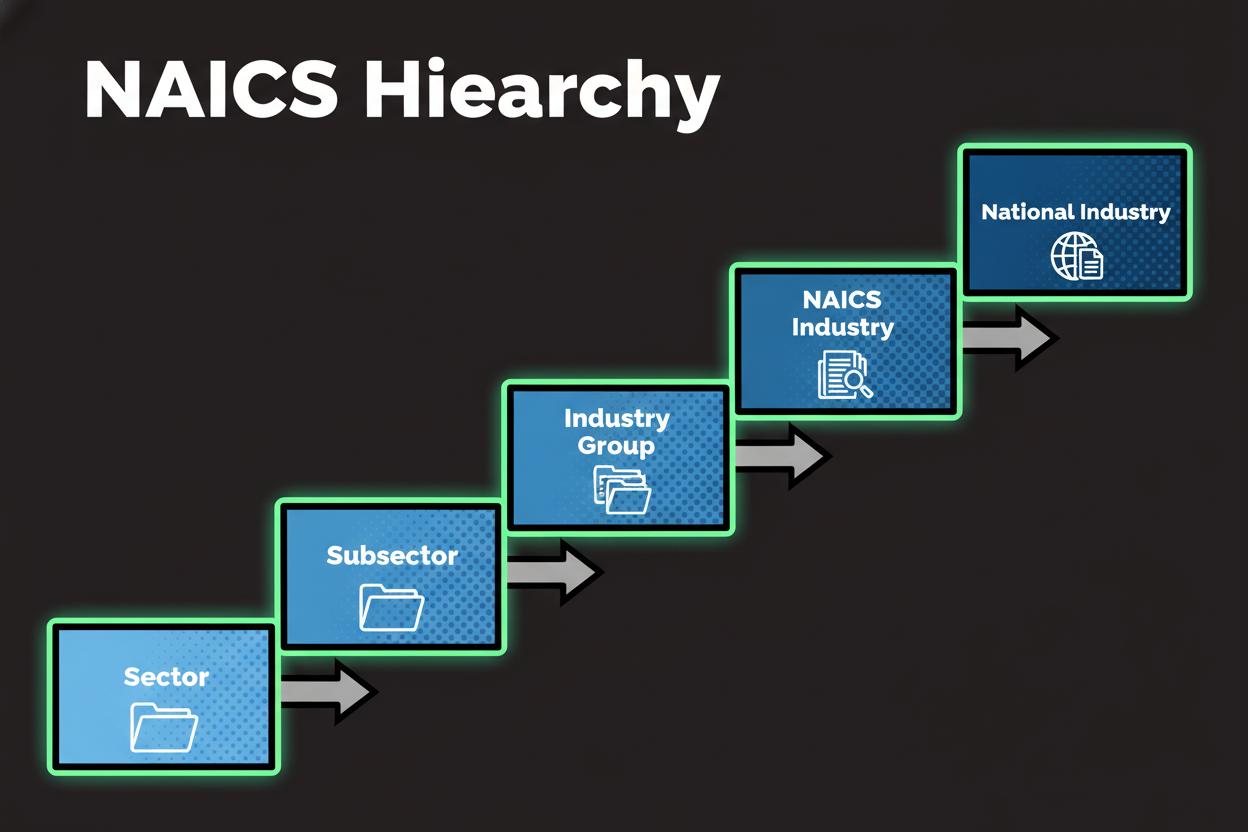

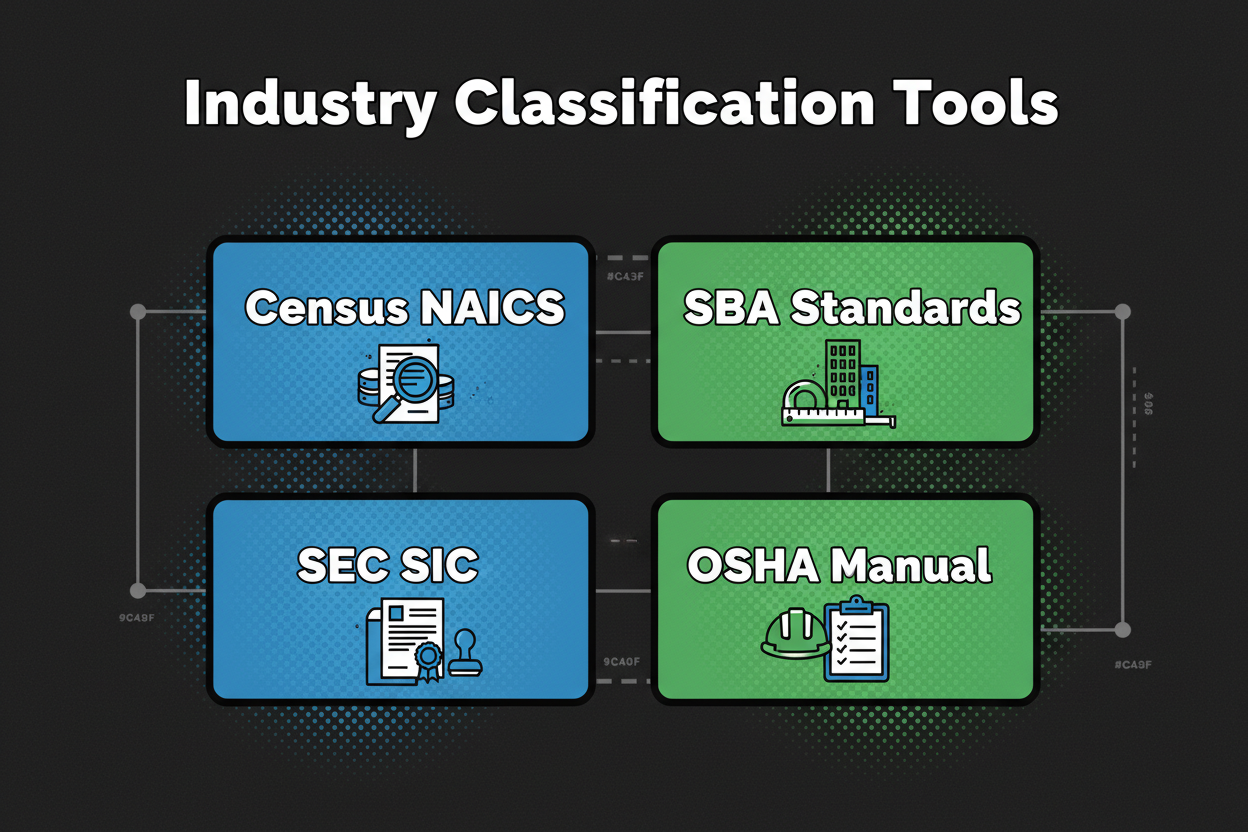

NAICS stands for North American Industry Classification System. It’s how U.S. federal statistical agencies describe industries in a consistent, production-oriented way. NAICS covers 20 broad sectors and over 1,000 industries at the detailed national level. Agencies use it to organize data, and many business processes reference it as well [reference:1][reference:4].

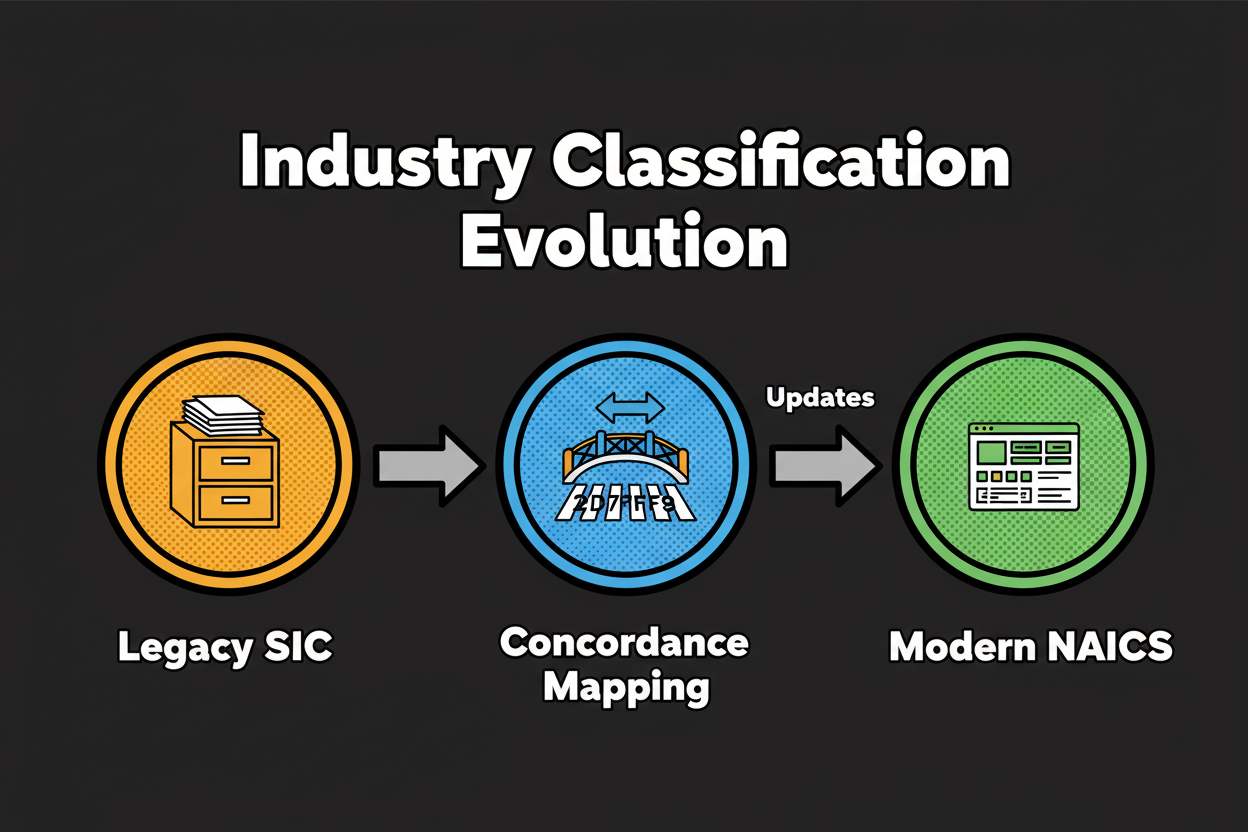

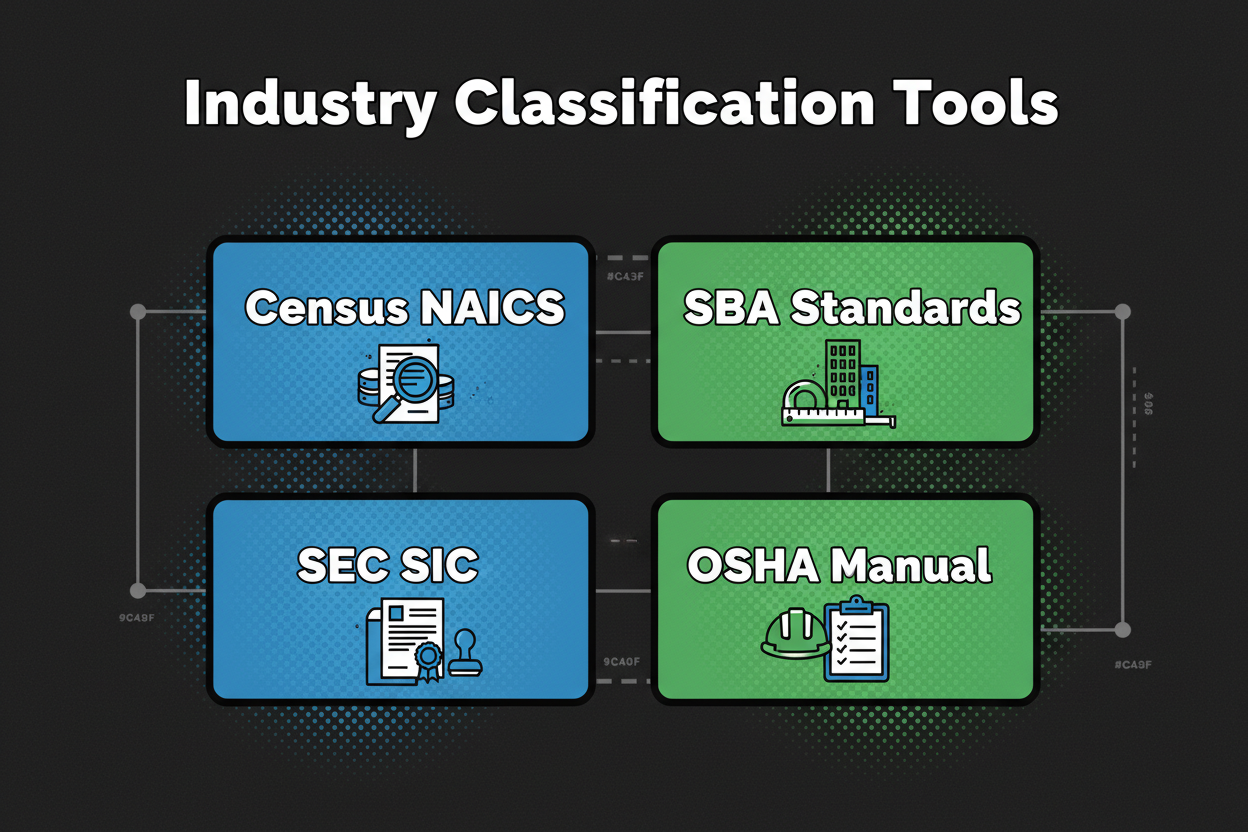

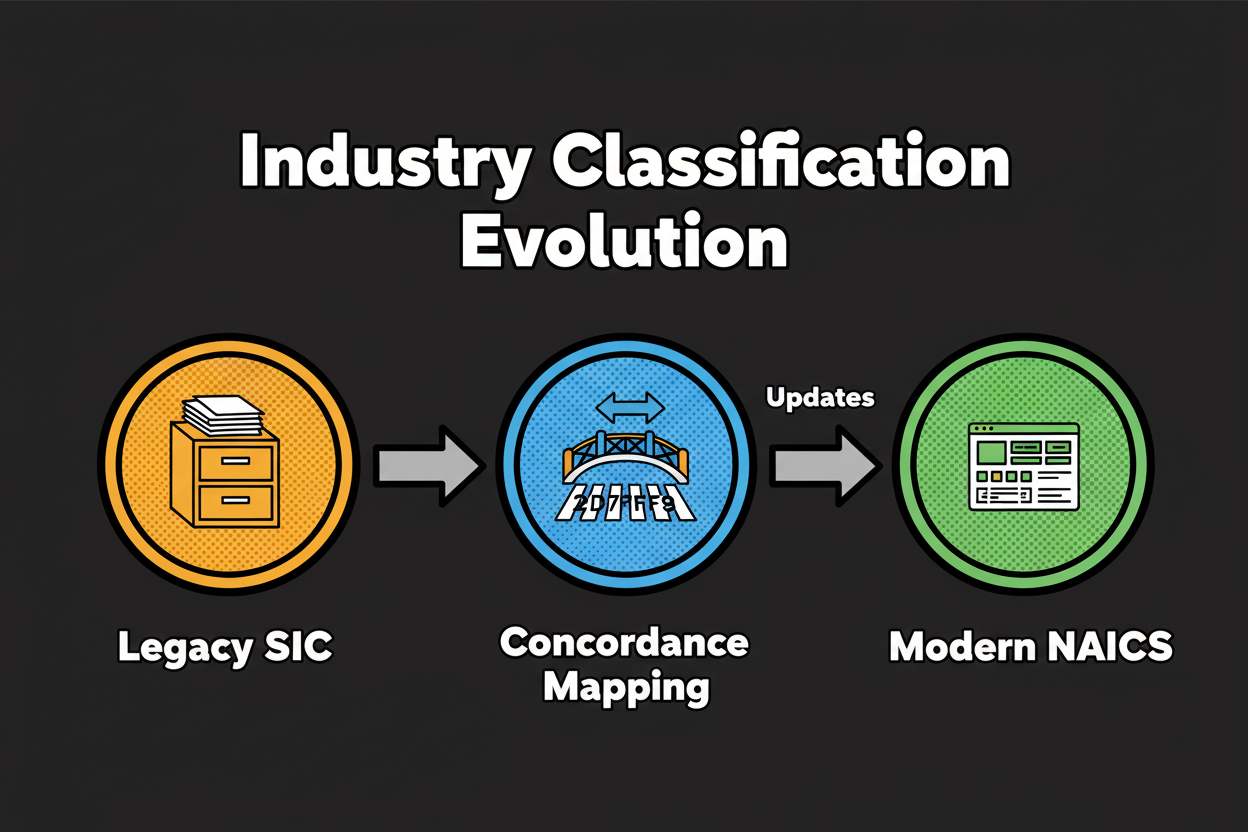

SIC stands for Standard Industrial Classification. It’s the older system that still appears in specific places like SEC filings and some legacy databases. You won’t use SIC daily if you’re focused on modern compliance, but you’ll still see it enough to matter, especially in financial reporting and historical analysis [reference:7][reference:8].

Here’s why NAICS and SIC Code Identification matters to you. The IRS asks for a principal business or professional activity code that aligns with NAICS when you file returns. The SBA ties small-business eligibility to NAICS-based size standards, which can open or close doors in federal contracting. OSHA bases some recordkeeping exemptions on NAICS categories. And SAM.gov requires NAICS for entities pursuing federal awards [reference:9][reference:5][reference:6][reference:10][reference:12].

- IRS – principal business activity code on tax filings aligns with NAICS [reference:9]

- SBA – small-business size standards and eligibility linked to NAICS [reference:5][reference:6]

- OSHA – partial recordkeeping exemptions depend on NAICS classification [reference:10]

- SAM.gov – federal registration requires NAICS for awards and opportunities [reference:12]

Let’s make this practical. A consulting firm we worked with selected a code that matched a side service, not their main revenue generator. The result: they showed up as “other than small” for key solicitations because the size standard on that code didn’t fit their true business model. After revisiting their primary activity and checking the SBA size standards tied to the right NAICS, they corrected their profile and regained access to small-business set-asides they were genuinely eligible for [reference:5][reference:6][reference:11].

In this guide, you’ll learn what NAICS and SIC are, how they differ, and how to identify the correct codes for your business the first time. You’ll get a simple step-by-step process, examples, and best practices you can reuse. We’ll also cover advanced scenarios, like multi-activity companies and evolving business models, so you can manage your codes with confidence.

Now that you see where classification shows up in your business systems, let’s demystify the codes themselves.

Understanding NAICS and SIC Codes: Fundamentals and Key Differences

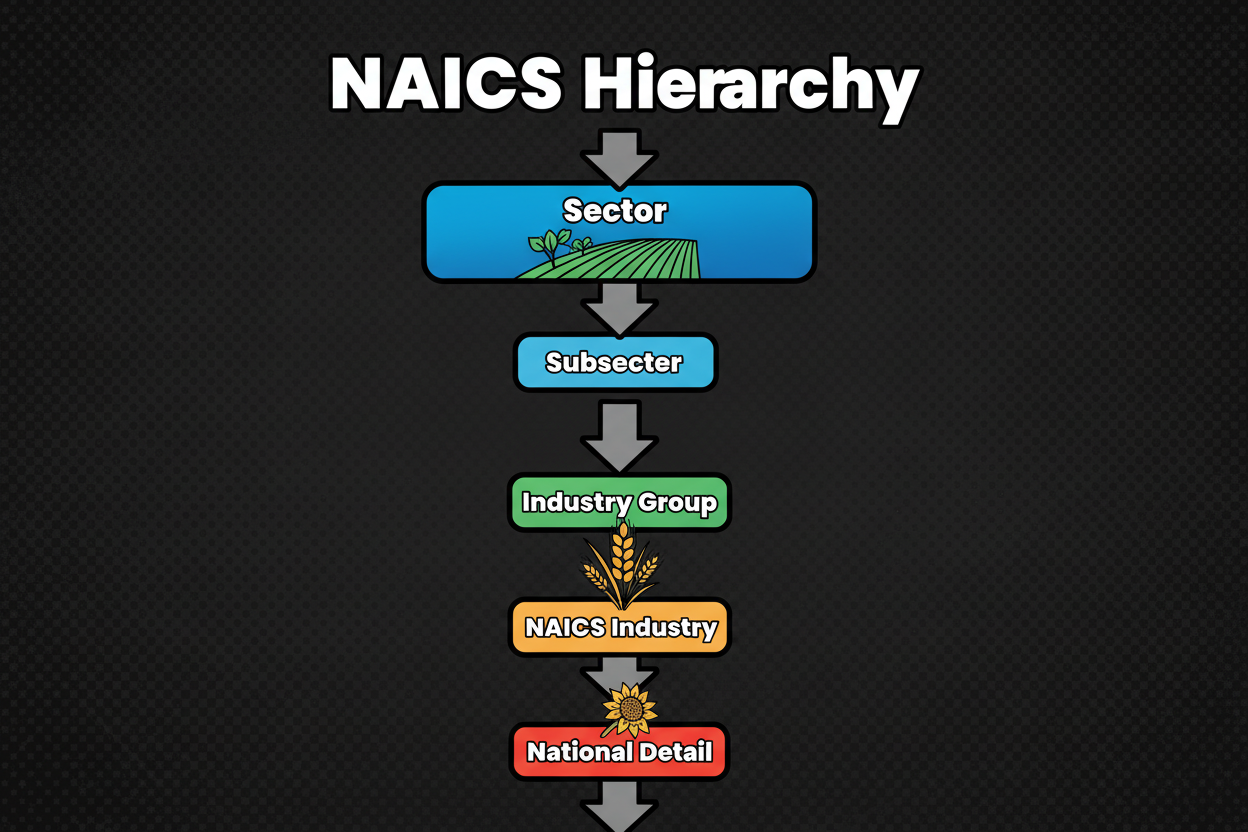

NAICS is a structured, production-oriented system. It organizes industries from broad sectors down to detailed national industries. The hierarchy runs from 2-digit sectors to 6-digit industries. It’s designed to reflect how goods and services are produced, not just how they’re sold or marketed. That’s why the official definitions include example activities, inclusions, and exclusions. The goal is clarity about what the industry actually does, not just its label [reference:1][reference:2].

SIC is the predecessor system. It uses 2 to 4 digits and appears in SEC filings and certain legacy datasets. Even though NAICS is the standard for most federal statistical purposes, SIC remains a fixture in capital markets and historical analyses. If you deal with investor relations, public filings, or older data warehouses, you’ll encounter SIC and might need to reconcile it with NAICS [reference:7][reference:8].

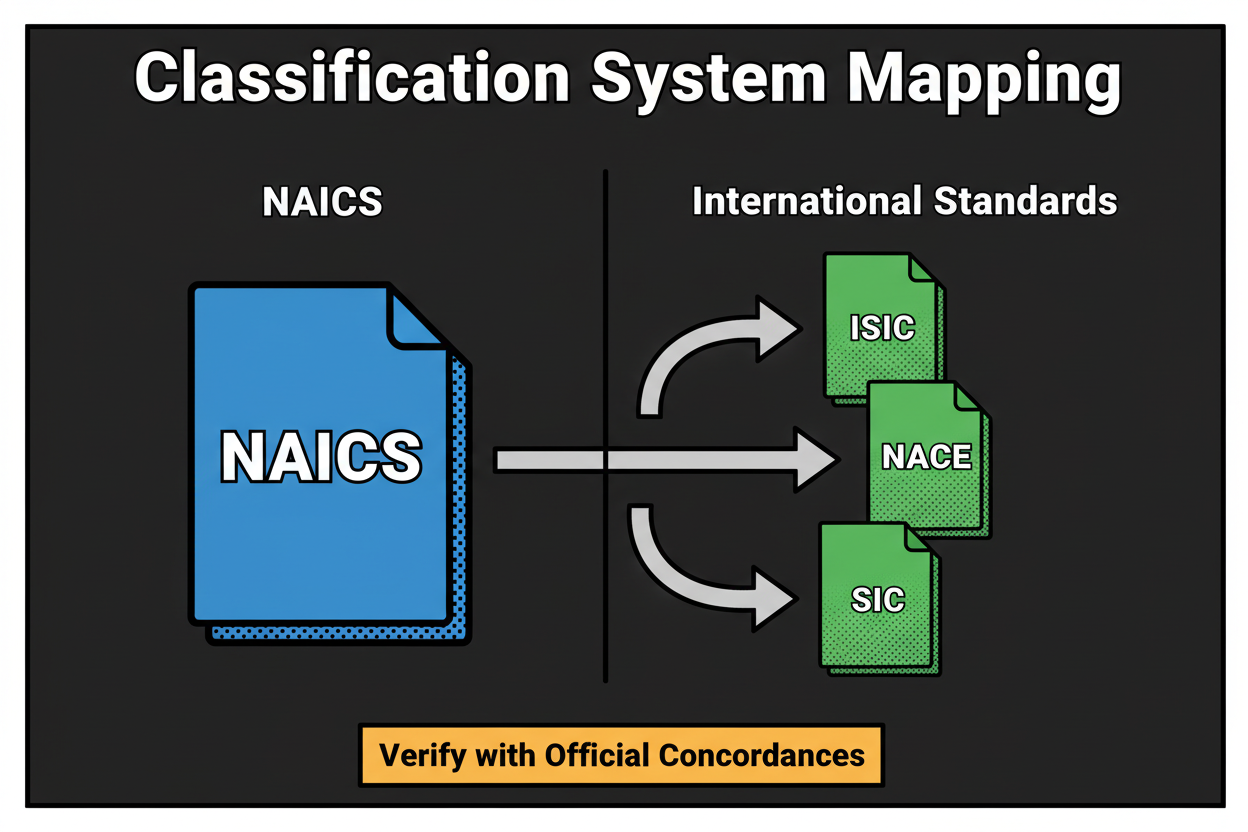

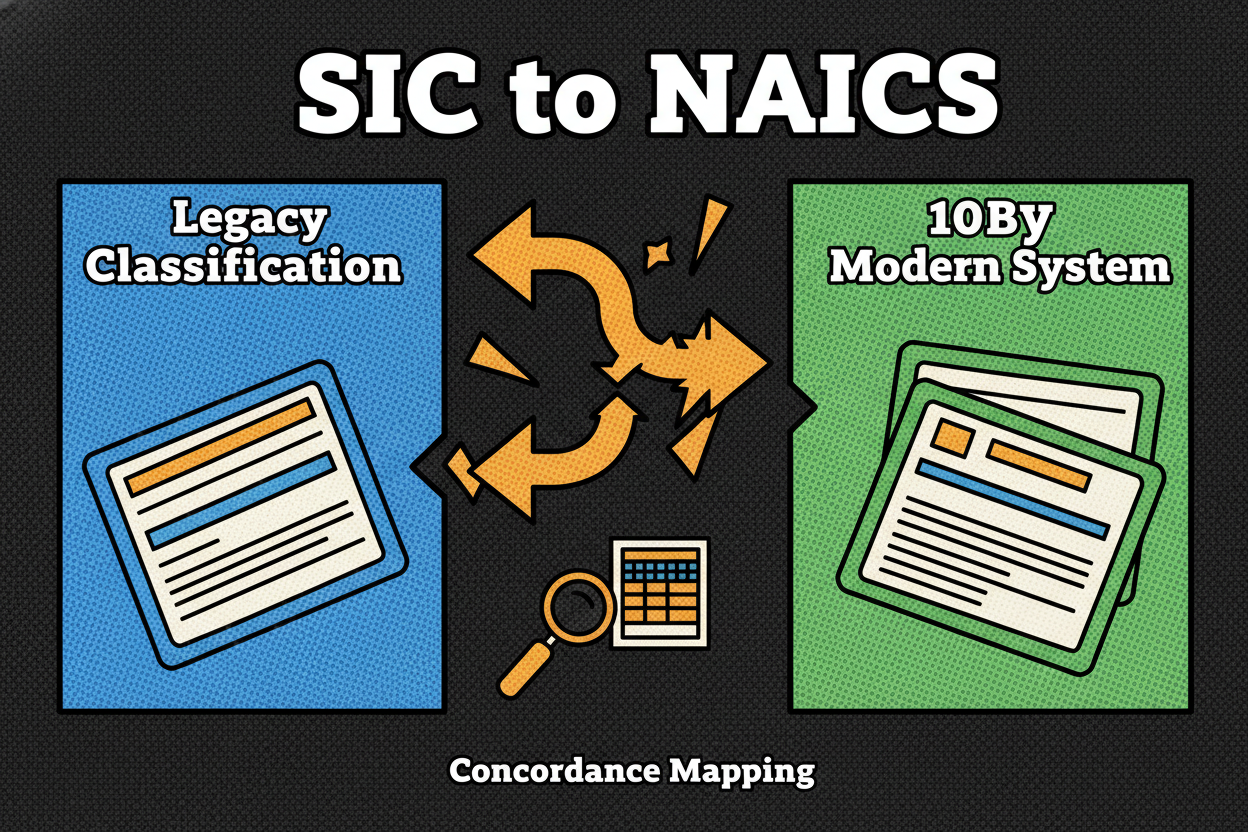

When you need to bridge systems, concordances are your friend. The Census Bureau publishes official crosswalks that map SIC to NAICS and connect older NAICS versions to newer ones. Concordances let analysts and compliance teams compare apples to apples across data sources and time periods. If your CRM or finance system still stores SIC and your compliance workflows run on NAICS, concordances help you translate without guesswork [reference:3].

| Feature |

NAICS |

SIC |

| Digit length |

2 to 6 digits |

2 to 4 digits |

| Orientation |

Production-based; detailed national industries |

Older structure; broader groupings |

| Primary U.S. use |

Federal statistics, contracting, SBA size standards |

SEC filings; some legacy systems |

| Official lookup |

Census NAICS search and definitions |

SEC SIC list; OSHA SIC manual |

| Crosswalks |

Official concordances available |

Map to NAICS via concordances |

[reference:1][reference:3][reference:7][reference:8]

What is the difference between NAICS and SIC codes?

NAICS is a modern, production-oriented system with 2 to 6 digits used by most U.S. agencies for statistics, contracting, and size standards. SIC is an older 2 to 4 digit system still used in contexts like SEC filings and some legacy databases. Use NAICS for most government reporting and SIC when a specific system requires it. [reference:1][reference:7][reference:8]

A few specifics make the distinction concrete. NAICS definitions include example activities and exclusions, helping you avoid look-alike industries that sound similar but operate differently. NAICS covers over 1,000 detailed national industries, offering finer granularity for analysis and reporting. By contrast, SIC groups are broader, which is why two companies that look identical in a modern market can fall into the same SIC but different NAICS codes based on how they produce value [reference:1][reference:2][reference:7].

Mini-example: A craft beverage company makes and sells its own product in a tasting room. Operationally, its primary activity might be beverage manufacturing under NAICS, not retail. But in SEC-style comparisons using SIC, it could be grouped with a broader beverage or consumer category. To reconcile across datasets, the company uses the official concordance to map its SIC reference to the appropriate NAICS for internal reporting [reference:3][reference:7][reference:1].

- NAICS is production-based, so choose codes by what you primarily produce or deliver, not just where you sell [reference:2]

- SIC still appears in SEC filings and some compliance tools, so keep a crosswalk handy [reference:7][reference:8][reference:3]

- NAICS has deeper detail at 6 digits, which supports analytics and size-standard checks [reference:1][reference:6]

- Official NAICS definitions include examples and exclusions – read them fully before deciding [reference:1]

- Use concordances to translate SIC to NAICS or align older NAICS versions with your current records [reference:3]

With the fundamentals in place, here’s a precise method to identify the right code the first time.

How to Identify the Correct NAICS and SIC Codes for Your Business

How do I find my NAICS code?

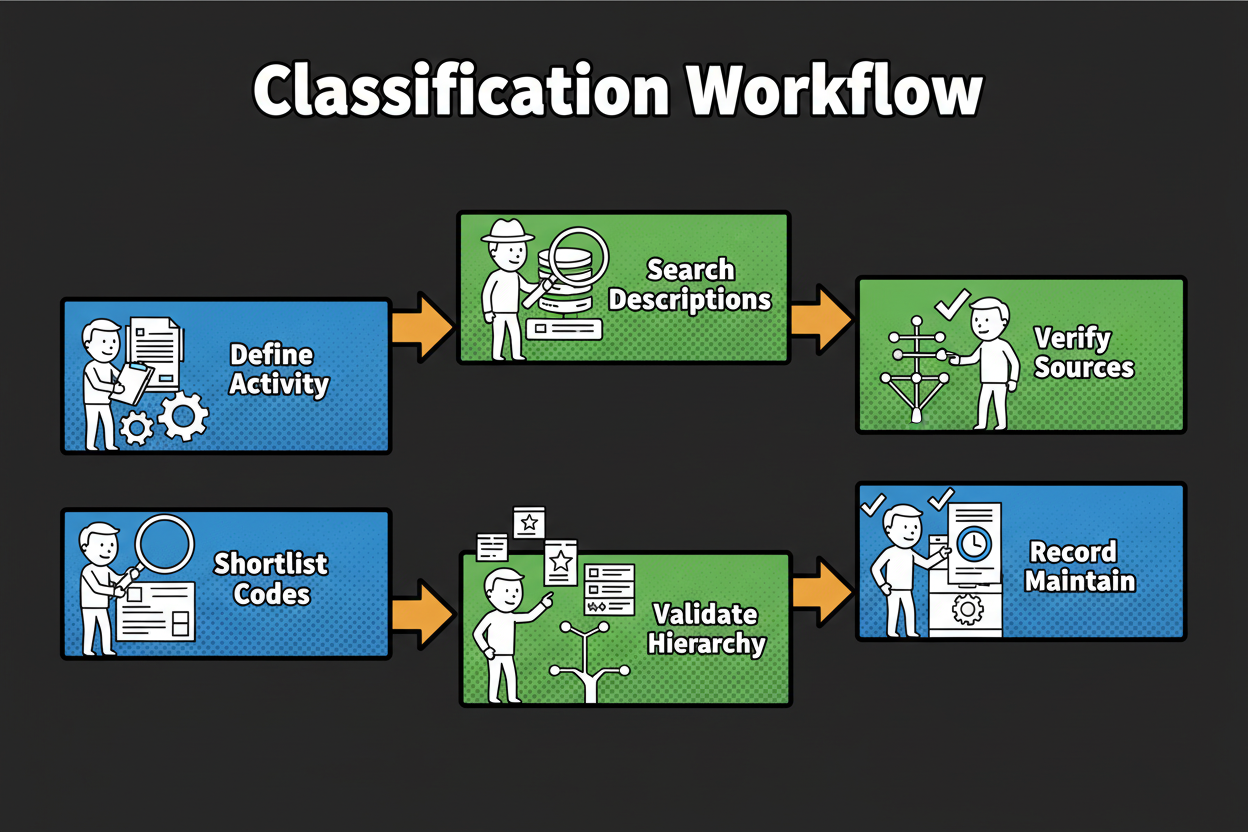

Use the official Census NAICS search, enter your core products or services, open candidate 6-digit industries, read full definitions and example activities, and select the code that best matches your primary revenue-generating activity. Document your rationale and check SBA size standards [reference:1][reference:2][reference:6].

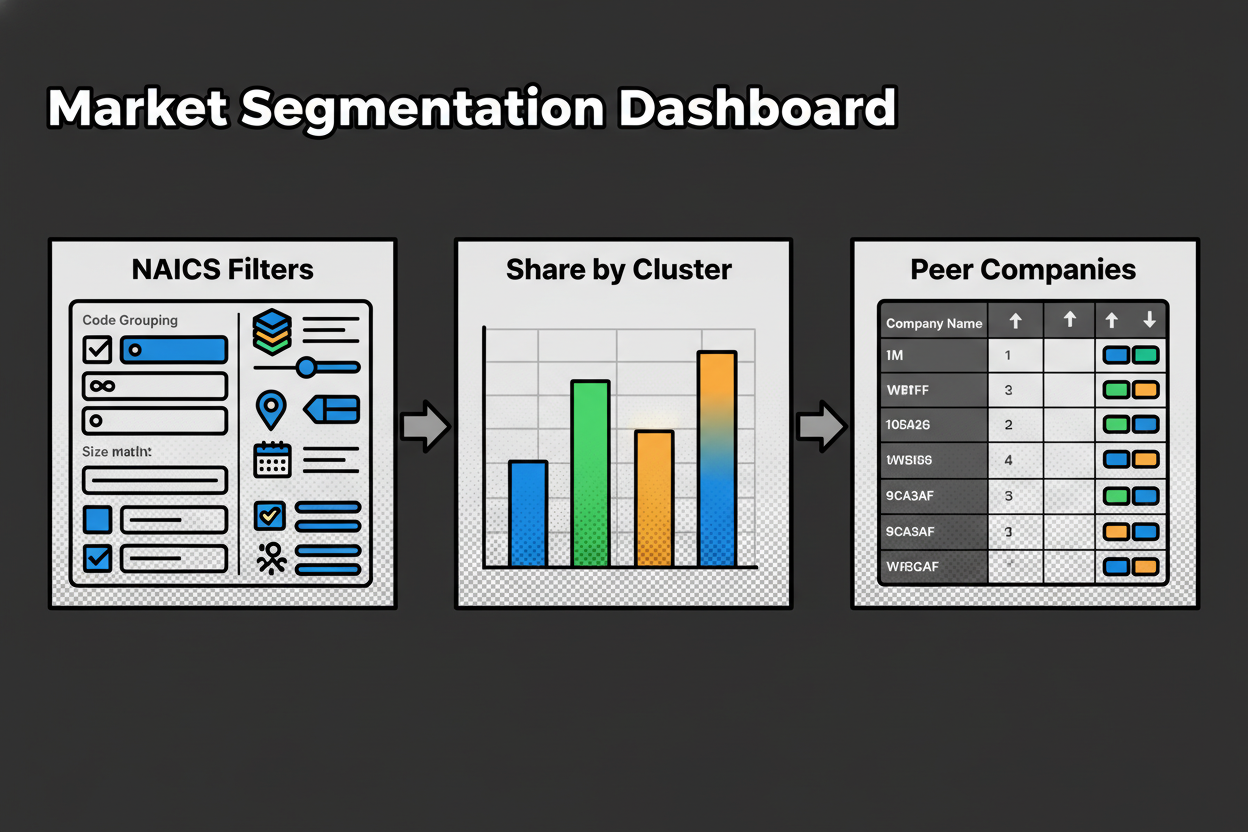

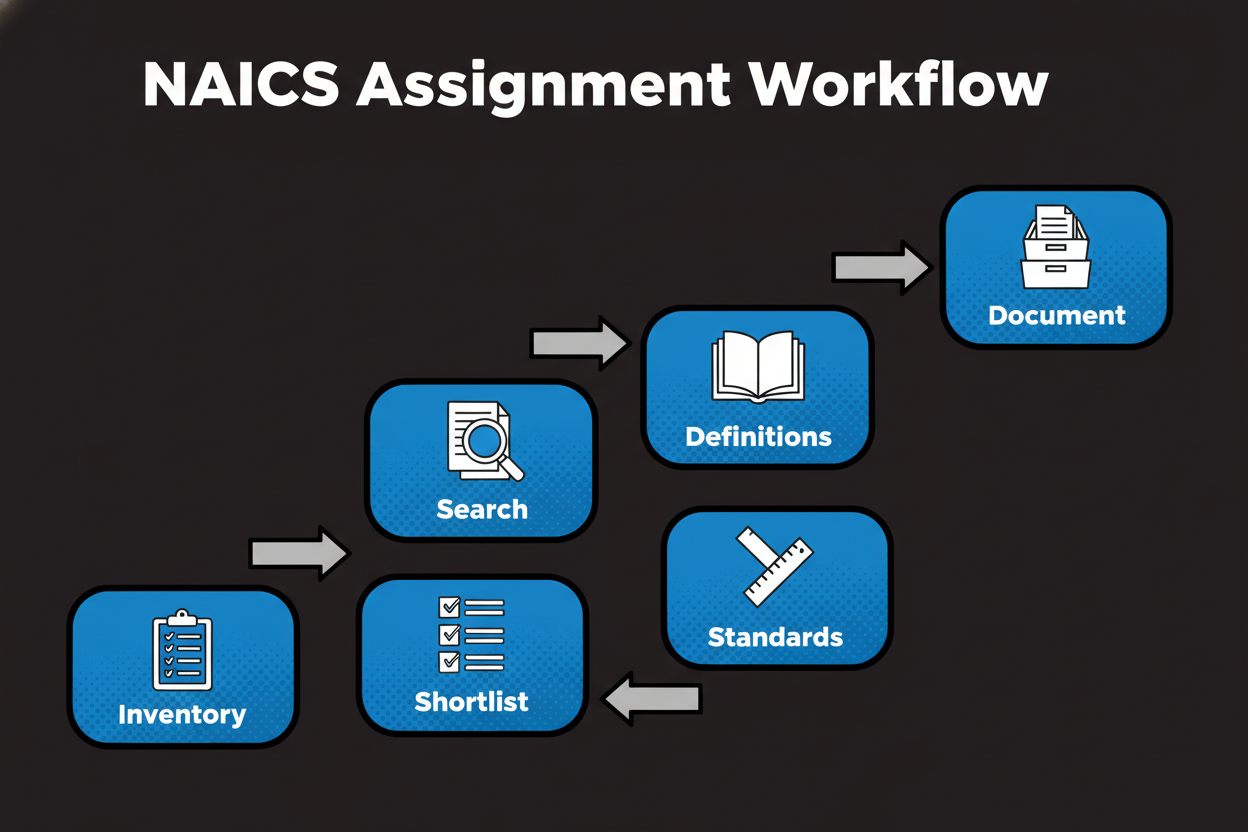

Start with how classification works. NAICS is assigned at the establishment level – a single location where business is conducted. Your primary activity is the one that accounts for the largest share of production or revenue. If your company has multiple establishments, each location can have its own primary NAICS based on what it actually does day to day. That’s why it’s common for a diversified enterprise to carry more than one NAICS across its footprint, even though each establishment has one primary code [reference:2].

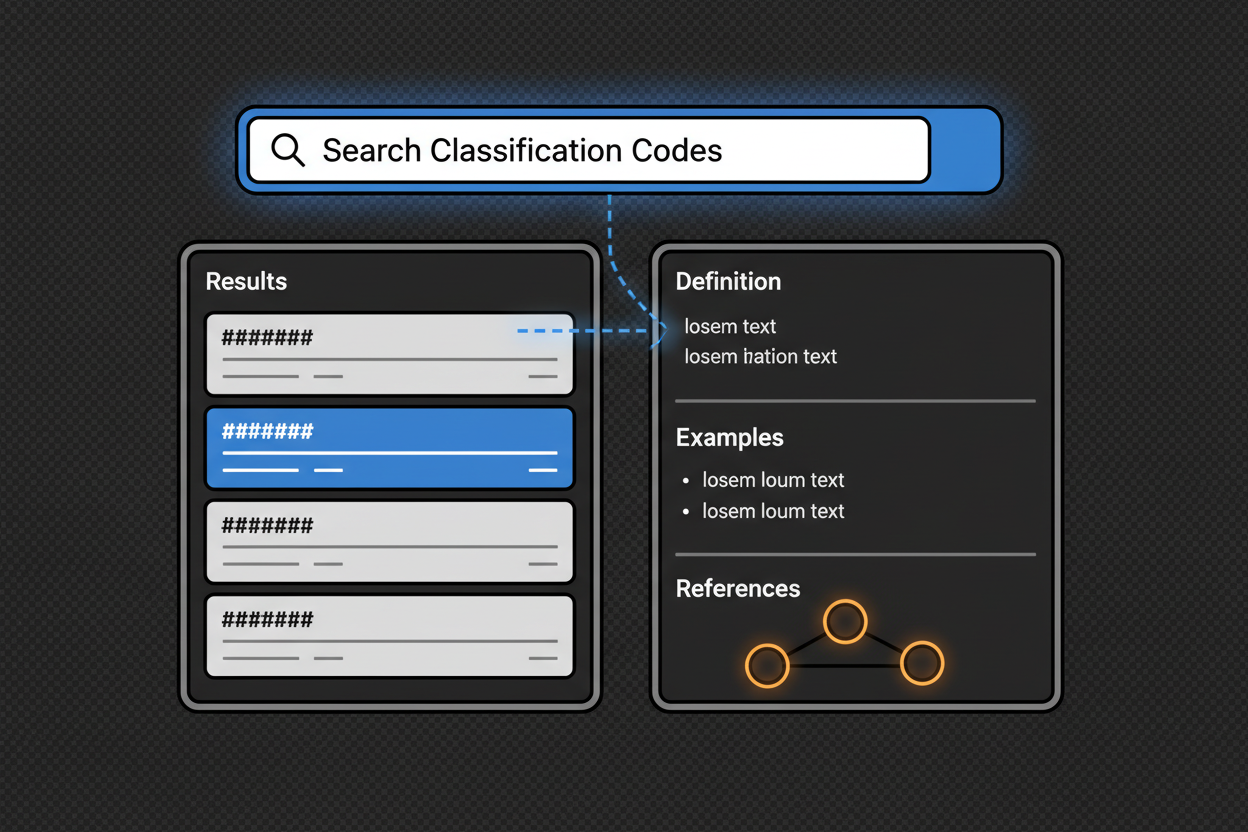

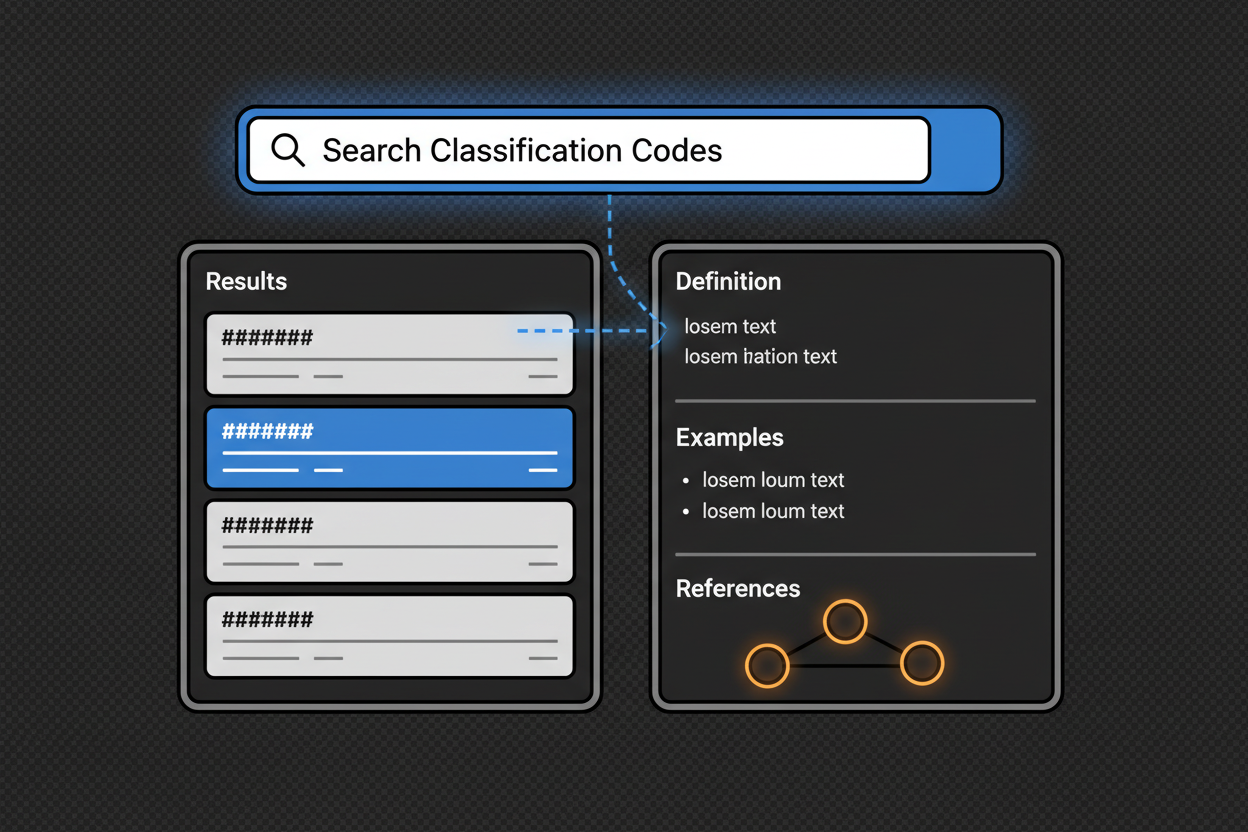

The fastest path is through the official Census NAICS website. Use the search tool, try a few different keywords for your main products or services, and open the candidate industries. Don’t stop at the title. Read the full definition. Look at the example activities and any explicit exclusions. Cross-references often point you to a better fit you didn’t think to search for initially [reference:1].

If federal contracting is in scope for you, pull up the SBA Table of Size Standards for the chosen NAICS. Confirm which metric applies – average annual receipts or number of employees – and note the threshold. This helps you anticipate your small-business status for solicitations that carry that NAICS and size standard. Remember, contracting officers assign one NAICS per solicitation, and SBA eligibility hinges on that assignment and the corresponding threshold [reference:6][reference:5][reference:11].

Some systems still ask for SIC. When that happens, use the SEC’s official SIC list or OSHA’s SIC manual. If you only know your NAICS, use the Census concordance to identify the best SIC analog. If you only know your SIC, map to NAICS using the same crosswalks, then validate by reading the target NAICS definitions and examples [reference:7][reference:8][reference:3].

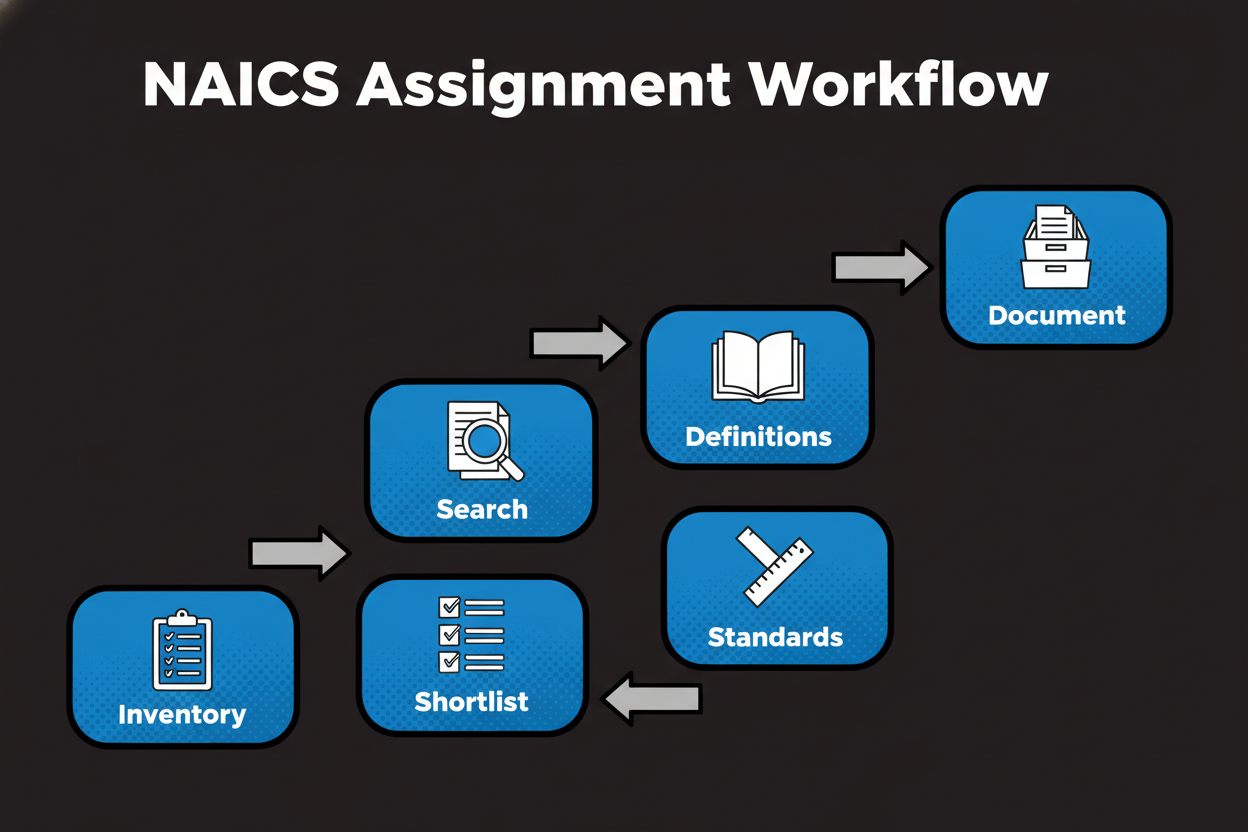

- Inventory your activities and revenue mix per establishment – identify the primary revenue-generating activity [reference:2]

- Use the official Census NAICS search – test multiple keywords and synonyms for your core offerings [reference:1]

- Open full 6-digit definitions – read examples, inclusions, and exclusions; follow cross-references to better fits [reference:1]

- Shortlist 2-3 candidates and document why you accept one and reject others; keep links or screenshots for your file [reference:1][reference:2]

- Check SBA size standards for your chosen NAICS if you plan to bid, partner, or certify as small; note the metric and threshold [reference:6][reference:5]

- If a partner or form requires SIC, look it up via SEC or OSHA and crosswalk it to NAICS using official concordances [reference:7][reference:8][reference:3]

- Update your records consistently – IRS principal activity code, SAM.gov profile, and any state or lender forms should match your chosen NAICS [reference:9][reference:12]

Mini walkthrough: Say you’re a marketing agency. You list services: campaign strategy, media buying, SEO, creative production. You check revenue – maybe 60 percent comes from campaign management and media buying. In the Census NAICS search, you test “advertising,” “media buying,” and “marketing services.” You open several 6-digit options, then read definitions to see which one covers your primary activity and includes example activities that mirror your work. You note two alternates that sounded right but exclude media buying as a primary service. You choose the best-fit NAICS, then open the SBA size standards table to confirm the receipts or employee threshold you’d face in solicitations carrying that code. You document the rationale and update SAM.gov and your internal records accordingly [reference:1][reference:6][reference:12].

Two practical guardrails keep you out of trouble. First, don’t pick a code to game SBA size standards. The regulation expects the NAICS to reflect the principal purpose of the work described in a solicitation, and misalignment can create eligibility issues and credibility concerns [reference:6][reference:11]. Second, your NAICS code on tax filings helps the IRS understand your business activity and for statistical purposes, but it does not determine how much tax you owe. Choose it to reflect reality, not to change your tax bill [reference:9].

Once you’ve selected a code, managing it over time is just as important. If your revenue mix or operations shift, revisit your classification with the same disciplined process and update your systems so everything stays in sync.

Advanced Strategies: Managing Codes for Multi-Industry and Evolving Businesses

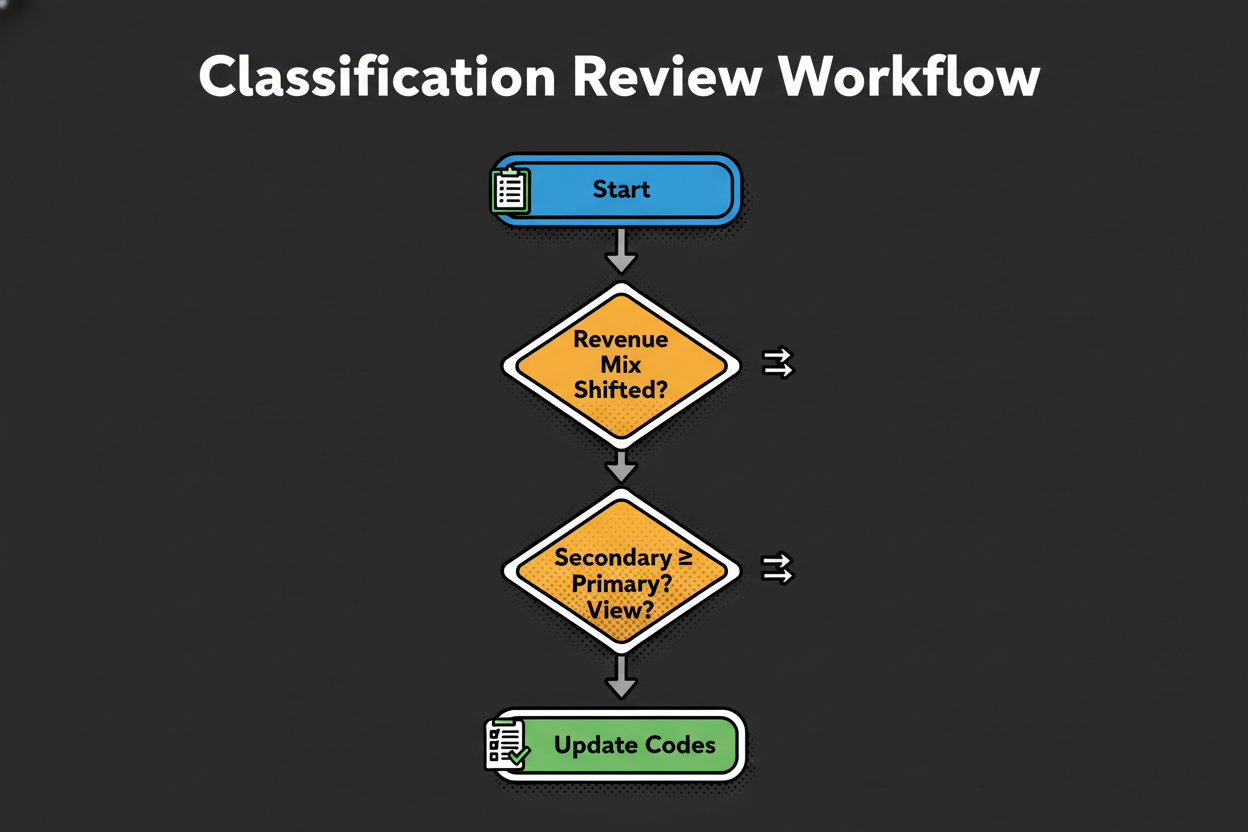

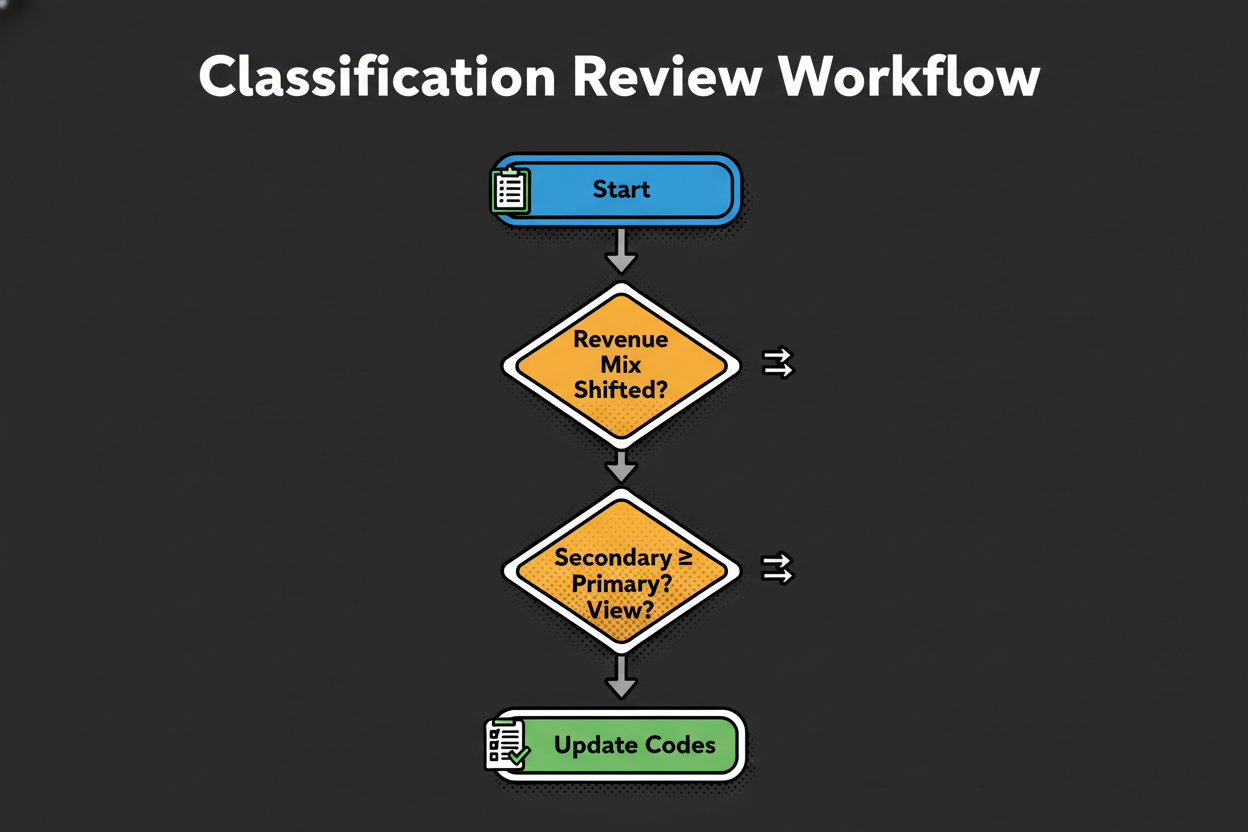

Once your code is set, the real work starts: keeping it accurate as your business changes. The NAICS rules classify at the establishment level, not only the enterprise. Each location has one primary activity based on the largest share of production or revenue. Secondary activities can be noted internally, but the primary code should follow where most value is created at that site [reference:2].

Two practical ways to weight activities are revenue share and value added. Revenue share is straightforward: if one activity consistently drives the majority of sales, it likely anchors your primary NAICS. Value added is useful when internal transfers or bundled offerings distort top-line revenue. NAICS guidance supports using the measure that best reflects actual production for the establishment [reference:2].

When should you update your primary NAICS? Look for material shifts. If a new line grows from 30 percent to 55 percent of an establishment’s revenue for sustained periods, it’s a strong signal to reclassify. New product launches, reorganizations that move production between locations, or a spin-up of a new facility are other clear triggers. The test is simple: does the primary activity, by revenue or value added, still match your current code [reference:2]?

Federal contracting adds a layer you can’t ignore. You can list multiple NAICS in your SAM.gov entity registration to reflect your capabilities. But each solicitation carries one assigned NAICS and a single SBA size standard that governs who is “small” for that opportunity. If an assignment seems off, review the statement of work, compare it to NAICS definitions, and submit a timely question to the contracting officer as allowed by the procurement rules. The regulation directs that one NAICS be assigned per solicitation and provides the framework for these determinations [reference:12][reference:11].

Hybrid and evolving models benefit from careful reading of definitions. SaaS often aligns with software publishing when your primary activity is producing and monetizing a standardized software product. Custom software projects may align with services-oriented development. Hosting and infrastructure can fall elsewhere. The right choice depends on what you primarily produce, not the marketing language on your site. The official NAICS definitions and cross-references will point you to the best fit if you read them fully [reference:1][reference:2].

E-commerce versus brick-and-mortar retail is another common fork. If your establishment’s core activity is retailing goods online, classification follows retail rules applicable to electronic shopping. A physical store with on-site sales typically sits in the relevant retail trade category. If you’re a marketplace, definitions and cross-references may point to a different area than a first-party retailer. Always match the definition to what the establishment actually does day to day [reference:1][reference:2].

As your data spans systems, use concordances to maintain continuity. The Census Bureau publishes official crosswalks that map SIC to NAICS and connect older NAICS versions to newer ones. Build a simple internal mapping table that lists your historical codes and their current equivalents, with links to official definitions. It keeps BI dashboards, finance, and compliance speaking the same language over time [reference:3].

Case study: A services firm opens a product unit and launches a subscription software tool. At the headquarters establishment, services once represented 70 percent of revenue. Within two planning cycles, the software line grows to 58 percent of that location’s revenue and carries the highest value added. The team updates the HQ establishment’s primary NAICS to reflect software production, retains a secondary internal note for professional services, and revisits small-business status using the SBA table tied to the new code. They remain eligible in some sectors but not others, which guides their bid strategy and teaming decisions [reference:2][reference:6].

The admin side matters too. When you change a primary NAICS, push the update through your core systems: SAM.gov, state registrations, and any lender or grant records. Keep a short memo with your rationale, revenue tables by establishment, links to official NAICS definitions you relied on, and the SBA size standard reference you checked. That file will save you hours later if a partner, auditor, or contracting officer asks for context [reference:12][reference:6][reference:1].

- Periodic review framework:

- Review revenue and value-added shares by establishment; flag shifts of 10 percentage points or more

- Scan official NAICS definitions; use concordances if your historical code’s scope has changed [reference:3]

- Recheck SBA size standards for your primary codes if contracting is strategic [reference:6]

- Confirm one NAICS per active solicitation and raise questions early if the assigned code doesn’t match the principal purpose [reference:11]

- Refresh SAM.gov and align internal and tax-facing records once decisions are final [reference:12][reference:2]

Complexity invites errors. In the next section, you’ll see the pitfalls the pros avoid and a simple checklist to keep you on track.

Common Mistakes and How to Avoid Them

The most common mistake is picking a code because a competitor uses it or it “sounds right.” NAICS selection should follow your primary activity, measured at the establishment level by revenue or value added, not market perception. If your main work is custom services but you choose a publishing code because the label feels modern, you’ll drift away from the official definitions and invite headaches later [reference:2].

Another pitfall is ignoring the example activities and exclusions inside the definitions. The right title can still be the wrong code if the examples don’t match how you produce value. The official NAICS pages include cross-references that often send you to a better fit in two clicks. Read them. They’re there for a reason [reference:1].

Some teams are tempted to choose a code to fit a more favorable SBA size standard. That backfires. Contracting officers assign a single NAICS per solicitation, and small-business status is determined against that code’s standard. If you select a code that doesn’t reflect the principal purpose of work or your primary establishment activity, you risk ineligibility or protest exposure. Better approach: align to the true activity and build your pipeline around opportunities where you legitimately qualify as small [reference:11][reference:6].

Operational consistency matters. OSHA uses NAICS to determine partial recordkeeping exemptions. A misclassification can add reporting burden you don’t need or, worse, cause you to miss required logs. The IRS asks for your principal business or professional activity code on Schedule C and uses it for processing and statistics. Keep your code truthful and consistent across systems. And remember, NAICS doesn’t change how much tax you owe; it classifies your activity, not your liability [reference:10][reference:9].

Here’s a quick scenario. A firm applied for a small-business set-aside loan program and targeted federal work. They chose a services code with a low receipts threshold and, based on their current revenue, looked “other than small.” After reviewing their actual work, they updated to a more accurate NAICS that better matched their primary activity and fell under an employee-based threshold. That alignment, confirmed against the SBA table, restored eligibility and focused their capture on the right solicitations [reference:5][reference:6].

Two concrete checks reduce surprises. First, note whether your target size standard is receipts-based or employee-based, because that choice changes your growth runway and reporting prep. Second, bookmark the IRS instructions that ask for the principal business activity code, so your tax team can update it in the next filing cycle without a scramble [reference:6][reference:9].

- Final validation checklist:

- Read the full 6-digit NAICS definition, examples, and exclusions before deciding [reference:1]

- Confirm primary activity at the establishment level by revenue or value added, not brand positioning [reference:2]

- Verify the SBA size standard for your chosen code and note whether it’s receipts or employees [reference:6]

- Check OSHA implications, including any partial recordkeeping exemptions tied to your NAICS [reference:10]

- Align IRS principal activity code, SAM.gov profile, and state records to the same selection [reference:9][reference:12]

- Write a short internal memo with your rationale, supporting links, and a plan to revisit during annual planning

Keep this list close. It will save you from last-minute surprises in bids, audits, and filings. Next up, we’ll answer the questions teams ask most so you can keep momentum without second-guessing your choices.

Frequently Asked Questions About NAICS and SIC Code Identification

You’ve done the heavy lifting. You understand primary activity, you’ve shortlisted codes, and you’ve sanity-checked size standards. Still, a few practical questions always come up: how to change a code, whether you can have more than one, what to do when an assignment looks off, and how to handle digital models like SaaS or marketplaces.

Here’s a straight-shot FAQ that mirrors what real teams ask during tax season, SAM.gov updates, and federal bids. Where it helps, we point you to official sources so you can verify in minutes, not hours [reference:1][reference:6][reference:9][reference:11][reference:12].

How do I change my business’s NAICS or SIC code?

Update your principal business activity code on the next tax filing, adjust your entity profile in government registration portals, and reflect the change in any state or industry systems that store your classification. Keep a short internal memo documenting your rationale and the official definitions you used.

Changing your code is mostly housekeeping, but do it carefully. Update the IRS principal business activity code in your next filing cycle and match your SAM.gov profile and state records to the same selection for consistency [reference:9][reference:12]. If you operate in multiple states or maintain lender records, mirror the change in those systems too.

Can a business have more than one code?

Yes. You can list secondary codes for meaningful lines of activity, but each establishment has one primary code that reflects its main revenue-producing activity. For federal solicitations, a single NAICS is assigned to each opportunity.

This rule keeps analysis and eligibility simple: one primary per establishment, one NAICS per solicitation. If an RFP’s code doesn’t match the described work, you can ask the contracting officer to review, citing official definitions [reference:2][reference:11].

What happens if I use the wrong code?

Misclassification can affect small-business eligibility, safety recordkeeping obligations, and how your data is analyzed. It usually does not change tax owed by itself, but it can cause mismatches and delays. Correct it by selecting the best-fit code based on your primary activity and updating your records.

Two common symptoms: unexpected OSHA recordkeeping triggers or missed small-business eligibility. Fixing the code and updating your registrations typically resolves both. And again, your NAICS code doesn’t set your tax liability; the IRS uses it for processing and statistics [reference:10][reference:5][reference:9].

Where can I find official code lookup tools?

Use the official NAICS search to read full definitions and examples, check small-business size standards by NAICS, consult the SEC SIC list or OSHA SIC manual when a system requires SIC, and use official concordances to map between systems.

Bookmark these and you’ll save hours in future reviews. The Census NAICS site gives you definitions and examples, the SBA table shows applicable thresholds, and concordances help you translate between systems cleanly [reference:1][reference:6][reference:7][reference:8][reference:3].

How do I classify SaaS, e-commerce, or marketplaces?

Choose the code that best reflects your primary activity. Compare definitions for software publishing, custom software services, hosting, retail, or marketplace facilitation. Read example activities and exclusions to confirm the best fit.

Digital models often span multiple definitions. Read the official NAICS pages in full, paying close attention to inclusions, exclusions, and cross-references. That’s where the right fit reveals itself [reference:1][reference:2].

Can I challenge a NAICS code in a solicitation?

Yes. Ask the contracting officer to clarify the assigned NAICS if it does not match the described work. Provide a brief rationale pointing to official industry definitions.

Time is your friend here. Raise questions during the solicitation window and ground your rationale in official definitions and example activities. Remember, each solicitation carries a single NAICS and the size standard tied to it [reference:11].

How do I map a SIC code to a NAICS code?

Use official concordances to identify candidate NAICS codes from a SIC code, then read the NAICS definitions and example activities to pick the best match for your operations.

This is how you align historical datasets, public filings, and modern operational reporting. Start with the concordance, then validate by reading the NAICS definition end-to-end [reference:3][reference:7][reference:1].

If you take one thing from this FAQ, let it be this: always read the official definition and examples, then document your reasoning. It protects you when questions arise and keeps your IRS, SAM.gov, OSHA, and contracting workstreams aligned [reference:9][reference:12][reference:10][reference:11].

Conclusion: Next Steps for Confident Business Classification

Accurate NAICS and SIC Code Identification isn’t busywork. It shapes your SBA eligibility, your OSHA recordkeeping duties, how the IRS processes your returns, and how contracting officers treat your bids. One thoughtful selection now avoids countless corrections later [reference:5][reference:6][reference:10][reference:9][reference:11].

Here’s a compact plan you can run this week to lock in a correct, defensible classification.

- Audit your activities and revenue by establishment; confirm the true primary activity [reference:2]

- Shortlist candidate NAICS using the official Census search and read full definitions and examples [reference:1]

- Verify the SBA size standard tied to your chosen NAICS and note receipts vs employees [reference:6]

- Document your rationale with links to definitions and any concordance mapping you used [reference:3]

- Update your IRS principal business activity code, SAM.gov profile, and state records [reference:9][reference:12]

- Schedule a periodic review to catch shifts in revenue mix or new product lines [reference:2]

Keep your internal memo handy and revisit it as your business evolves. When definitions or data needs shift, use the official concordances to maintain continuity across systems without reinventing your analytics [reference:3]. Do this consistently, and your classification will stop being a hurdle and start working as a lever for growth.