Table of Contents

- Introduction: Why Economic Activity Classification Systems Matter

- Understanding NAICS, NACE, and ISIC: Scopes, Structures, and Applications

- Key differences between NAICS, NACE, and ISIC: what professionals need to know

- Aligning and mapping data across NAICS, NACE, and ISIC: practical frameworks

- Frequently asked questions: NAICS, NACE, and ISIC classification

- Conclusion: choosing and aligning the right economic activity classification system

Introduction: Why Economic Activity Classification Systems Matter

If you report across borders, you’ve felt the pain. One dataset arrives coded in NAICS, another in NACE, and a third in ISIC. The categories look similar at the top, then splinter as you go deeper. Revenue gets double counted, risk scores drift, and compliance teams start asking questions.

Economic activity codes are the backbone of how governments, lenders, and analysts describe what businesses actually do. They drive national statistics, tax rules, procurement policies, and industry benchmarking. If your codes are wrong, everything you build on top of them is shaky.

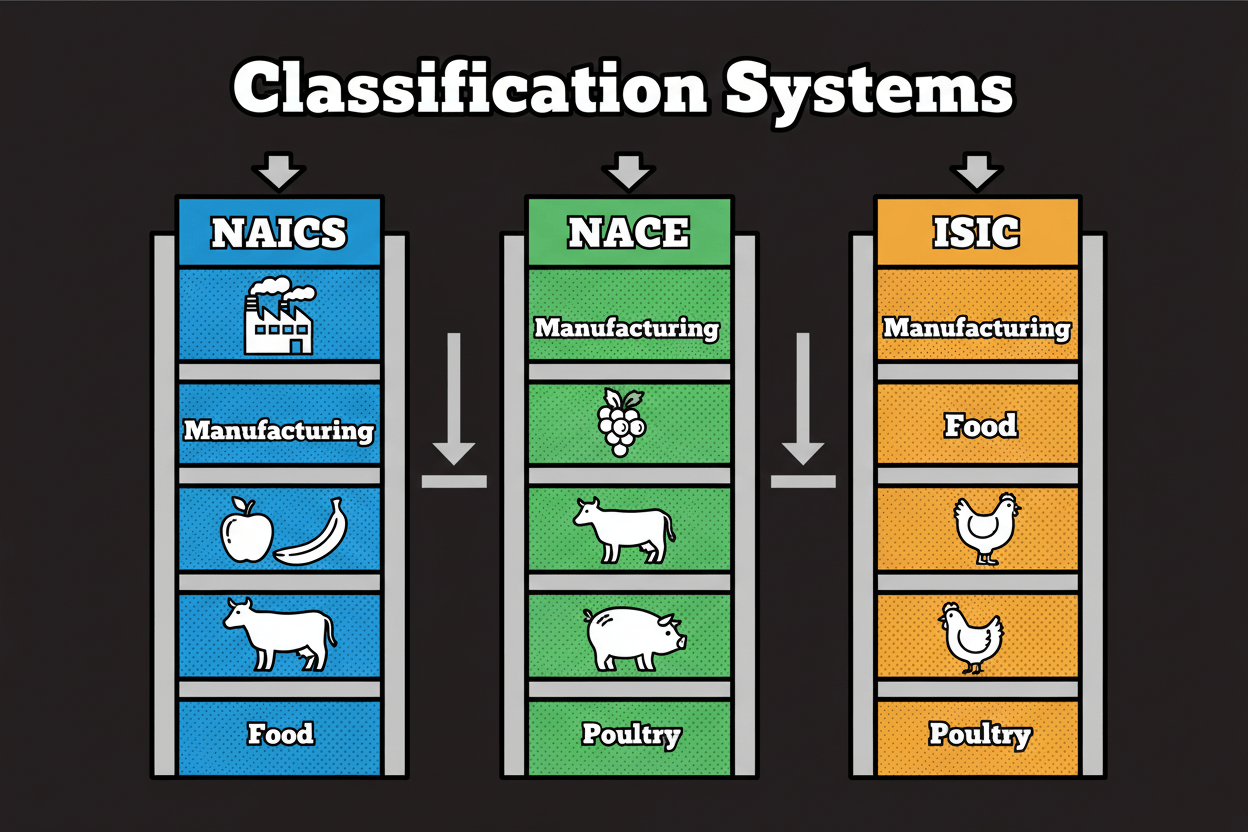

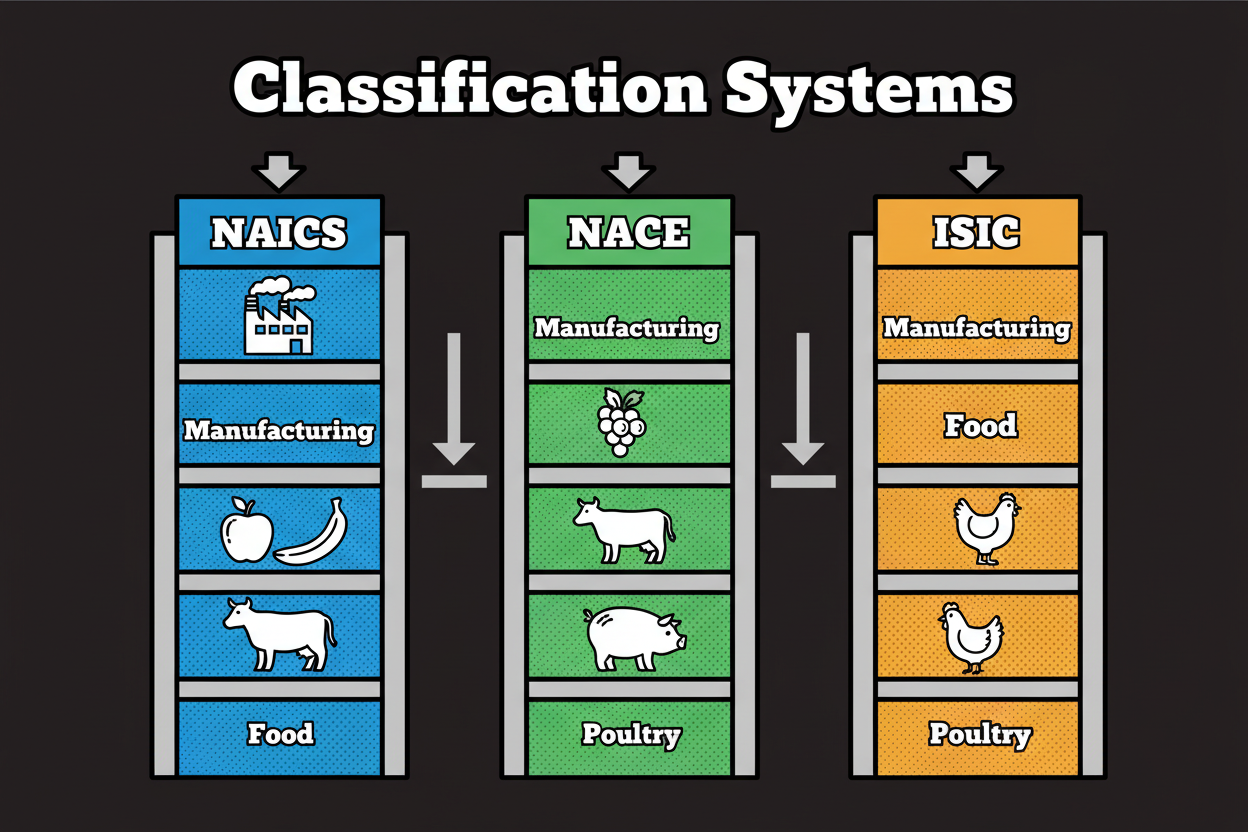

Most teams run into trouble when they try to stitch together US and EU data or when they benchmark global peers. NAICS classification is standard across North America. NACE classification is required across the European Union. ISIC classification, managed by the United Nations, sets the global baseline. Each system has its own structure, wording, and depth. Close, but not identical.

So you need two superpowers: understand how the systems are built, and map between them without losing meaning. That’s what this guide gives you. We’ll walk through scopes and structures, call out key differences that trip up analysts, and share practical mapping frameworks you can put to work right away.

Before we dive in, here’s the regional picture at a glance.

(Note: Upload your ‘naics-nace-isic-geographic-scope-map.png’ image here)

You’ll also see where to find official definitions and correspondences that professionals rely on. NAICS structures and manuals live at the U.S. Census Bureau. NACE materials are maintained through Eurostat’s RAMON. ISIC documentation and concordances are published by the UN Statistics Division. These official repositories are the anchors for clean classification work.

Ready for the fast version first?

Quick Answer: NAICS vs NACE vs ISIC

- NAICS: Maintained through the U.S. statistical system (Census hosts NAICS materials) for North America; used for national statistics, regulation, and analytics.

- NACE: Managed by Eurostat via the RAMON server for the European Union; used for EU statistics, regulation, and compliance reporting.

- ISIC: Published by the UN Statistics Division for global use; supports international comparability and often acts as a neutral bridge across systems.

- Crosswalk reality: census.gov does not host a NAICS–ISIC crosswalk. Practitioners use UNStats and Eurostat correspondences, combined with NAICS structures, to align codes across borders.

Understanding NAICS, NACE, and ISIC: Scopes, Structures, and Applications

NAICS classification: purpose, hierarchy, and North American usage

NAICS (North American Industry Classification System) groups business establishments by their primary economic activity. It underpins core federal statistics and many regulatory and procurement workflows across the United States, and it is also used in Canada and Mexico.

The hierarchy is numeric and progressive. At the top you have 2-digit sectors. These break down into 3-digit subsectors, 4-digit industry groups, and 5–6 digit industries for national detail. A typical path looks like 31 (Sector) → 311 (Subsector) → 3116 (Industry group) → 311615 (Industry). The structure and official explanatory notes are published by the U.S. Census Bureau, which serves as the authoritative repository for NAICS materials.

NACE classification: EU governance, hierarchy, and reporting role

NACE (Nomenclature of Economic Activities) is the European Union’s standard for classifying economic activity. It’s governed through the EU statistical system, and Eurostat maintains the official materials and correspondences in the RAMON classification server.

The structure mirrors ISIC’s terminology: Section, Division, Group, Class. The code format combines a lettered Section (like C for Manufacturing) with numeric levels, typically shown with dots, such as 10, 10.1, 10.12.

ISIC classification: the UN’s global standard and common bridge

ISIC (International Standard Industrial Classification of All Economic Activities) is published by the United Nations Statistics Division. It serves as the global reference classification and the starting point for many national systems, including NACE.

Like NACE, ISIC uses Section, Division, Group, and Class. Codes are letter plus numbers, such as C → 10 → 101 → 1012. ISIC definitions are designed for international comparability, which is why analysts frequently use ISIC as a neutral bridge.

Side-by-side structures at a glance

| Attribute | NAICS | NACE | ISIC |

|---|---|---|---|

| Issuer | U.S. Census Bureau | Eurostat (RAMON) | UN Statistics Division |

| Region | North America | European Union | Global |

| Hierarchy | Sector → Subsector → Industry group | Section → Division → Group → Class | Section → Division → Group → Class |

| Format | 2–6 digits | 1 letter + 2–4 digits | 1 letter + 2–4 digits |

| “Manufacturing” | Sector 31–33 | Section C | Section C |

Key differences between NAICS, NACE, and ISIC

Definitions and hierarchy choices that change outcomes

- E-commerce vs retail storefront: NAICS classes often focus on the merchandise line, while NACE/ISIC have stricter boundaries for store vs non-store.

- SaaS vs custom software: NAICS separates packaged software from custom programming; NACE/ISIC boundaries can blur if delivery models aren’t tested.

- Marketplaces vs retailers: Platforms that don’t own inventory should be classified as intermediaries. If you map by “Gross Merchandise Value” instead of activity, you’ll misclassify them.

Case study: US-to-EU alignment with an ISIC bridge

A US retailer with European subsidiaries adopted ISIC as a bridge.

- Step one: Map NAICS 44–45 (Retail Trade) into ISIC Section G.

- Step two: Map those ISIC codes into NACE Section G.

This two-step process reduces ambiguity because ISIC and NACE share nearly identical structures, whereas mapping NAICS directly to NACE often results in messy “one-to-many” outcomes.

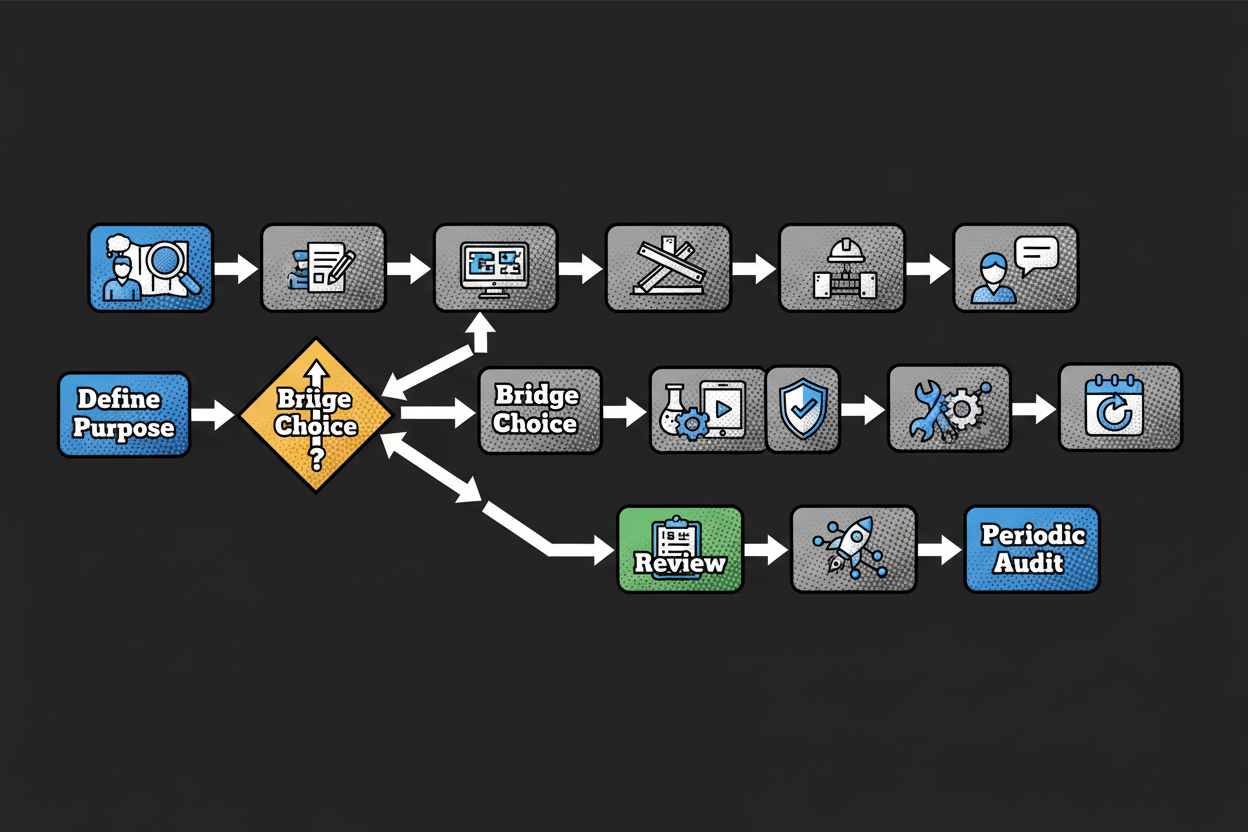

Aligning and mapping data: practical frameworks

- Define purpose: Lock the exact editions (e.g., NAICS 2022) you are mapping.

- Collect official materials: Use Census (NAICS), RAMON (NACE), and UNStats (ISIC).

- Choose a bridge: Map via ISIC for international projects.

- Validate: Confirm boundaries using official explanatory notes.

- Periodic review: Revalidate after any structural updates.

Frequently asked questions

Q: What is the main difference?

NAICS is North American; NACE is European; ISIC is the UN’s global standard used as a “bridge” between the two.

Q: How do I map a NAICS code to NACE?

Because census.gov doesn’t host a direct NAICS-to-ISIC crosswalk, the most reliable method is to map NAICS → ISIC first, then ISIC → NACE using UNStats concordances.

Q: Where can I download official lists?

- NAICS: census.gov/naics

- NACE: Eurostat RAMON server

- ISIC: unstats.un.org/classifications

Conclusion

Your classification choice shapes your data’s accuracy. By anchoring your definitions to official notes and using ISIC as a neutral bridge for cross-border analytics, you ensure your reporting remains compliant and comparable.

Key Takeaways

- Confirm jurisdiction requirements before choosing a system.

- Always use official explanatory notes for boundary decisions.

- Use ISIC as a neutral bridge for international datasets.

- Establish version control for your mapping tables.