When navigating the complex world of international trade, one term importers and exporters frequently encounter is the tariff code. Whether you are shipping electronics, textiles, or agricultural products, understanding tariff codes is essential to ensure smooth customs clearance, accurate duties calculation, and compliance with international regulations. This comprehensive guide will help you grasp what tariff codes are, why they matter, and how you can use tools like Classifast.com to make classification easier and more precise.

What Is a Tariff Code?

A tariff code, often referred to as a Harmonized System (HS) code or customs code, is a numerical identifier assigned to products in international trade. These codes classify products based on their material composition, nature, and use, allowing customs authorities worldwide to recognize and apply appropriate tariffs, taxes, and regulations.

Tariff codes are standardized internationally through the World Customs Organization’s Harmonized System (HS). The HS system comprises a 6-digit code used globally, which countries then expand upon with additional digits to suit national tariff schedules.

Why Are Tariff Codes Important for Importers and Exporters?

Tariff codes play several crucial roles in international trade:

- Customs clearance: Accurate tariff codes ensure timely and hassle-free customs processing.

- Duty and tax calculation: Determine the correct import duties and taxes applicable to your products.

- Trade compliance: Help avoid penalties or shipment delays due to misclassification.

- Trade statistics: Enable governments and businesses to track import/export volumes by product type.

- Eligibility for trade agreements: Certain tariff codes qualify products for preferential treatment under trade deals.

Understanding and correctly applying tariff codes can save importers and exporters significant time and money, reducing the risk of costly compliance errors.

Structure of Tariff Codes: How to Read Them

Most tariff codes follow the structure set out by the HS system:

- Chapters (2 digits): Broad category of goods (e.g., 61 for textiles).

- Headings (4 digits): More specific grouping within the chapter (e.g., 6101 for men’s or boys’ coats).

- Subheadings (6 digits): Detailed product description (e.g., 6101.10 for overcoats, not knitted).

Countries can add further subdivisions for national purposes. For example, the United States uses a 10-digit code called the Harmonized Tariff Schedule (HTS).

How to Determine the Right Tariff Code for Your Products

Assigning the correct tariff code can be complicated, especially if you deal with diverse or complex products. Here are some best practices to help:

- Check product description: Gather all details about the material, use, and manufacturing process.

- Refer to official customs resources: Visit your country’s customs website or tariff schedule for guidance.

- Use classification tools: Automated online classifiers like Classifast.com provide instant identification of tariff codes using international classification standards such as UNSPSC or HS.

- Consult an expert: Customs brokers or trade consultants can offer valuable assistance in classification.

- Review similar products: Check how similar items are classified in your market.

Benefits of Using Classifast.com for Tariff Code Classification

Classifast.com is an indispensable resource for importers and exporters who need fast and accurate tariff code assignments. Here’s why many businesses rely on it:

- Instant classification: Quickly generate UNSPSC, HS, NAICS, ISIC, and other codes from any text description.

- Multiple standards support: Access a wide range of international and regional classification systems.

- User-friendly interface: Designed for ease of use, you don’t need extensive customs knowledge.

- Time-saving: Reduces the time spent researching tariff codes manually.

- Increased accuracy: Minimizes errors that can lead to customs delays or penalties.

By using Classifast, businesses can confidently classify their products according to the latest international standards, ensuring compliance and smooth trade operations.

Common Challenges with Tariff Codes and How to Overcome Them

Though crucial, tariff codes can be a source of frustration for importers and exporters. Here are some common challenges:

- Product ambiguity: Some products do not fit neatly into one category.

- Constant updates: Tariff codes and rules change frequently.

- Multiple classification standards: Different countries or trade agreements can require different code versions.

- Complex products: Items with multiple components or usage purposes can be tricky to classify.

To overcome these issues:

- Stay updated with international tariff revisions.

- Use up-to-date classification tools like Classifast.

- Train staff or engage customs specialists.

- Document the classification rationale for audit purposes.

Step-by-Step Guide to Finding Your Tariff Code

Here is a simple process to find and confirm your product’s tariff code:

- Gather detailed product information: Material, function, origin, and manufacturing details.

- Search official tariff databases: Use your country’s customs portal.

- Use online classifiers: Input product description into a service like Classifast.com.

- Cross-check classifications: Verify the code with multiple sources.

- Seek expert advice if needed: To confirm or handle borderline cases.

- Keep records: Save your classification documentation.

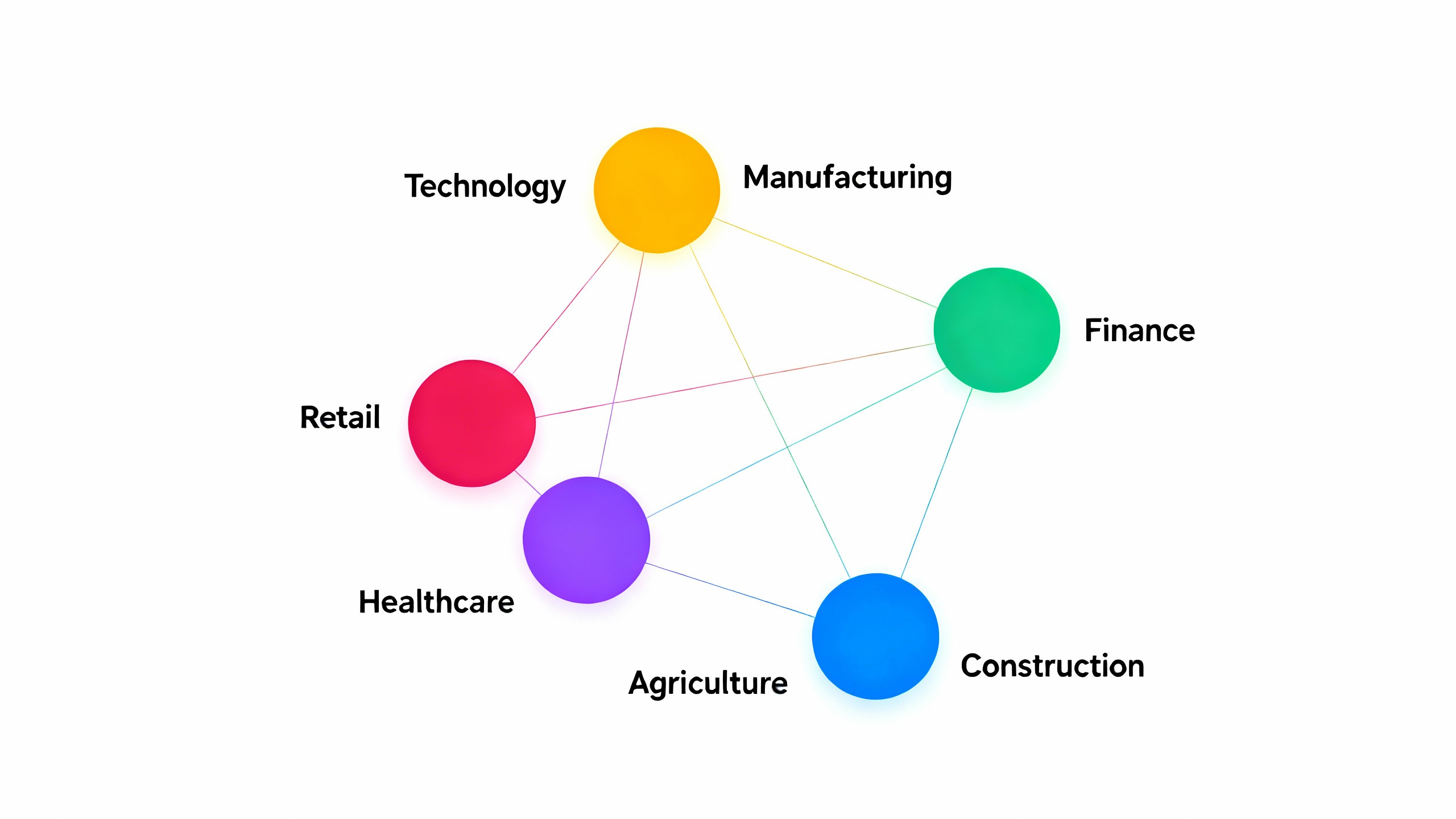

International Tariff Code Systems You Should Know

Besides the Harmonized System, the world uses several other classification systems connected to tariff codes:

| Classification System | Purpose | Typical Use |

|---|---|---|

| HS (Harmonized System) | Universal product classification | Import/export tariff codes |

| UNSPSC | Product/service categorization | Procurement and e-commerce |

| NAICS | Industry sector classification | Business statistics in North America |

| ISIC | International standard industrial activity classification | National economic planning |

| ETIM | Technical product classification | Electrical and technical industries |

| CN (Combined Nomenclature) | EU customs classification | EU import/export tariff code system |

| HS (Harmonized System) | Used globally for customs tariffs | Worldwide customs and trade |

Knowing which classification is relevant to your trade situation will help you correctly assign and use tariff codes.

Frequently Asked Questions About Tariff Codes

Q1: How do I find the correct tariff code for my product?

A1: Start by gathering detailed product information, then use official customs databases or online classifiers like Classifast.com to search by description. Consulting customs brokers is also advisable.

Q2: What happens if I use the wrong tariff code?

A2: Incorrect codes can lead to customs delays, fines, or penalties. It may also cause incorrect duty calculations, resulting in unexpected costs.

Q3: Are tariff codes the same worldwide?

A3: The first six digits of tariff codes under the Harmonized System are standardized globally, but countries may add extra digits for national requirements, so codes can vary beyond six digits.

For more detailed information on tariffs and regulations, you can consult official sources such as the World Customs Organization (WCO) Harmonized System website (source).

Conclusion: Streamline Your Import and Export Processes with Accurate Tariff Codes

Mastering the use of tariff codes is vital for any importer or exporter aiming to optimize customs compliance and reduce costs. Using authoritative resources, official tariff schedules, and clever online tools like Classifast.com can simplify the classification process and enhance accuracy.

Don’t let tariff code confusion slow down your international trade operations. Take advantage of instant classification tools today and ensure your products sail smoothly through customs on every shipment. Visit Classifast.com now to revolutionize your tariff code classification and stay ahead in global trade!