In today’s global marketplace, understanding the Harmonized System code is essential for businesses involved in international trade. Whether you’re exporting electronics, importing textiles, or shipping machinery, the correct classification of goods using the Harmonized System (HS) code ensures smooth customs clearance, accurate tariff application, and compliance with international regulations. This comprehensive guide will explore what the Harmonized System code is, how it works, its importance in global trade, and tools that can help streamline the classification process.

What Is the Harmonized System Code?

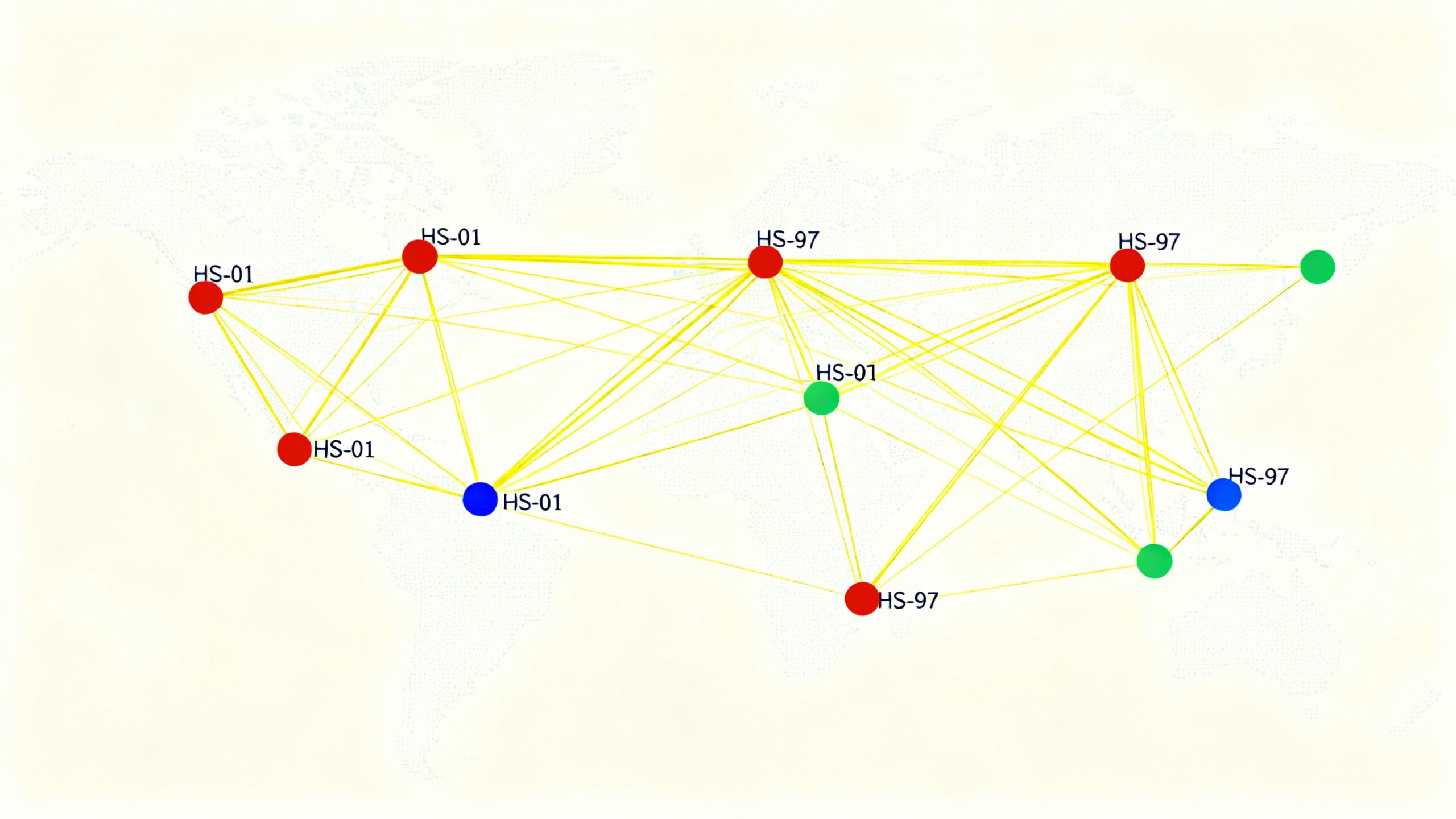

The Harmonized System (HS) code is an internationally standardized numerical method of classifying traded products, developed and maintained by the World Customs Organization (WCO). It is used by more than 200 countries worldwide and forms the basis for customs tariffs, trade statistics, and harmonized trade policies.

An HS code typically consists of six digits:

- The first two digits represent the chapter (broad category of goods).

- The next two identify the heading (a subset within the chapter).

- The last two denote the subheading (further detail about the product).

Some countries add additional digits beyond the initial six to create more detailed national classifications.

Why Is the Harmonized System Code Important for Global Trade?

Using the correct Harmonized System code is vital for several reasons:

- Customs Compliance: Proper classification ensures your goods are correctly declared and comply with import/export regulations.

- Tariff Determination: Customs duties vary depending on product codes, so the HS code directly affects the cost of moving goods across borders.

- Trade Statistics: Governments and international organizations rely on HS codes to track trade volumes and economic data.

- Risk Management: Misclassification can lead to delays, fines, or seizure of goods, negatively impacting your supply chain.

Because of these factors, companies must invest time in understanding and using the right HS codes for their products.

How to Find the Right Harmonized System Code for Your Products

Identifying the correct HS code can be challenging due to the intricacy and volume of goods categories. A step-by-step approach helps businesses achieve accuracy:

-

Describe Your Product in Detail

Clearly outline the product’s material, function, and composition. For example, “cotton T-shirts” vs. “synthetic fiber jackets” will belong to different HS headings. -

Consult Official Tariff Databases

Use your country’s customs or trade authority website. Many provide search tools and downloadable HS code directories. -

Use Classification Services and Tools

For quicker and more precise classification, tools like Classifast.com offer instant classification and category search for HS codes and other international standards such as UNSPSC, NAICS, ISIC, ETIM, and CN. By inputting any text description, you get recommended codes instantly, reducing human error and saving time. -

Verify with Customs Agent or Trade Specialist

If uncertain, consult a customs broker or trade expert to confirm your classification.

Examples of Harmonized System Code Usage

To illustrate, here are a few examples of HS codes and their corresponding products:

- 1006.30 — Rice (indicating a subheading within the chapter for cereals)

- 8517.12 — Mobile phones, including smartphones

- 6204.63 — Women’s cotton dresses

Knowing these codes helps businesses prepare accurate shipping documentation, avoiding costly delays.

Harmonized System Code vs. Other Product Classification Systems

The HS code primarily handles trade goods classification and serves as a universal base. However, various industries might also need classifications according to systems like:

- UNSPSC (United Nations Standard Products and Services Code)

- NAICS (North American Industry Classification System)

- ISIC (International Standard Industrial Classification)

- ETIM (ElectroTechnical Information Model)

- CN (Combined Nomenclature used by the European Union)

Platforms such as Classifast.com can classify any text according to these multiple standards instantly, making it an excellent resource for companies trading internationally.

Benefits of Accurate Harmonized System Coding

Accurate HS coding yields numerous benefits:

- Streamlines customs clearance and minimizes border delays.

- Ensures correct tariff and tax application.

- Enables clear trade statistics and reporting.

- Helps avoid penalties from misclassification.

- Facilitates targeted market analysis and business planning.

Common Challenges in Using the Harmonized System Code

Despite its widespread adoption, traders face several challenges when working with HS codes:

- Complexity: The system includes thousands of codes spanning many product variants.

- Frequent Updates: The WCO revises HS codes every five years to accommodate new products and technology.

- National Variations: Some countries add digits or interpret codes differently, creating potential confusion.

- Language Barriers: Classifications and descriptions may not always be available in traders’ native languages.

Using classification tools and consulting experts can mitigate many of these challenges.

How to Keep Your Harmonized System Code Data Up to Date

Given the HS system’s dynamic nature, staying current is essential:

- Regularly check WCO updates and your country’s customs authority announcements.

- Use software or classification platforms that automatically update their databases.

- Participate in customs webinars or training sessions to stay informed.

FAQ: Harmonized System Code Insights

Q1: What is the difference between a Harmonized System code and a tariff code?

A Harmonized System code is the internationally standardized product classification; a tariff code is often the HS code used within a country’s tariff schedule for determining duties.

Q2: How can I find the Harmonized System code for my product quickly?

Instant classification services like Classifast.com allow you to input a product description and receive accurate HS codes along with other classification standards.

Q3: Are Harmonized System codes the same worldwide?

The first six digits are standardized internationally; however, additional digits or codes may vary by country for further classification.

Conclusion: Mastering Harmonized System Codes for Seamless Global Trade

Grasping the significance of the Harmonized System code and learning how to apply it accurately is crucial for anyone engaged in global trade. It’s not merely a set of numbers—it’s the language that facilitates international commerce and regulatory compliance. To optimize your import/export processes, avoid costly errors, and enhance your trade efficiency, invest in reliable tools like Classifast.com that offer instant and accurate HS code classification. Stay proactive with updates and expert advice to maintain smooth operations across borders. Start leveraging the power of proper product classification today to expand your global reach with confidence.

For more information on classification tools and to try instant product categorization, visit Classifast.com. Accurate classification is your first step toward hassle-free international trade.

References:

World Customs Organization. “HS Nomenclature.” https://www.wcoomd.org/en/topics/nomenclature/overview.aspx (source)